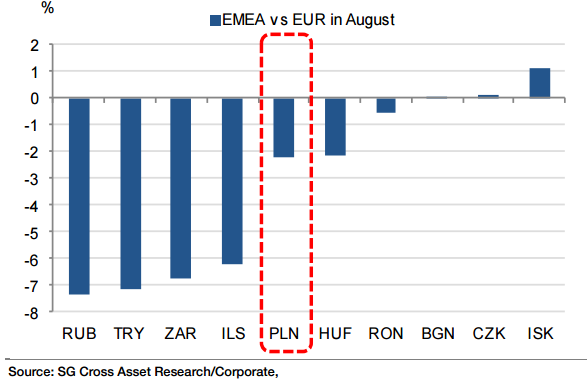

Poland's smaller trade linkages to China and its status of net commodity importer places the PLN in a relative sweet spot compared to other EM currencies. That did not stop EUR/PLN from gaining 2.1% in August. A move up to 4.30 is not ruled out if equity market turmoil persists and the run-up to Poland's general election adds political uncertainty.

USD/PLN rose only 0.14% over the past month and has failed so far to exit the 3.6297-3.8566 trading range in place since May. The economy expanded 3.3% yoy in Q2-15 while CPI edged up in July to -0.7% from -0.8% in June. The NBP kept its key interest rate unchanged at 1.50% on 2 September.

"Our EM colleagues initiated a long PLN/ZAR trade at 3.32", says Societe Generale.

Poland’s October election adds downside PLN risk

Friday, September 4, 2015 1:02 AM UTC

Editor's Picks

- Market Data

Most Popular

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns  Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade

Trump Offers U.S. Insurance and Naval Escort for Tankers as Strait of Hormuz Crisis Disrupts Global Oil Trade  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets

European Stocks Slide as Middle East War Fears and Rising Oil Prices Shake Markets  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears  China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI  Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears

Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears  China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security