We’re told Australia has a progressive tax system – the more you earn, the higher the rate.

And that’s certainly the case for earnings from wages. An Australian on A$35,000 sacrifices 21 cents out of each extra dollar they earn whereas an Australian on $90,000 sacrifices 39 cents.

That’s how it’s meant to be for income from savings, but in practice it isn’t.

Fresh calculations released this morning by the Tax and Transfer Policy Institute at the Australian National University show that low income Australians in the bottom tax bracket pay a higher marginal rate of tax on income from savings than high earners in the top tax bracket.

It is because of exemptions and special rates, and the alacrity with which high earners take advantage of them.

Super gives the most to the highest earners

The taxation of superannuation drives the results.

Super contributions are generally taxed at a flat rate of 15%. For low earners on an income tax rate of zero, 15% would constitute a considerable extra impost did the government not refund the difference with a tax offset that cuts the effective rate to zero.

High earners on the 47% marginal rate do much better. The tax rate of 15% offers substantial tax relief. For them, it is an effective rate of minus 32%.

Other tax concessions are directed at older Australians, who are often on higher incomes than younger Australians.

Highest bracket, lowest rate

Our calculation of the marginal effective annual tax rates actually paid on income from savings is published in a report entitled the taxation of savings in Australia: theory, current practice and future policy directions.

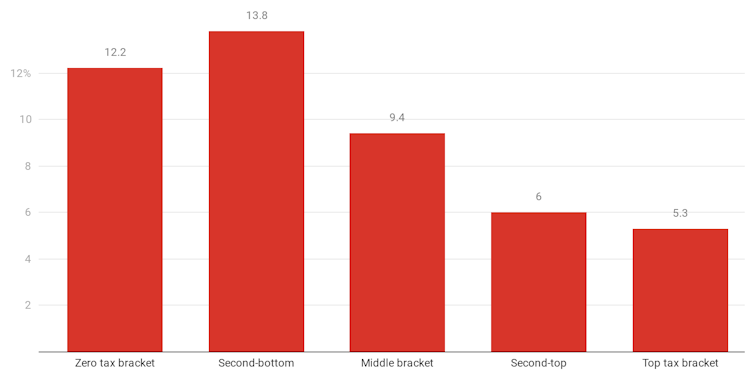

It shows that the marginal tax rate high earners pay on additional savings held over a twenty year period is 5.3% of income, on average, whereas for low earners in the bottom (zero) tax bracket it’s 12.2%.

Low earners in the second lowest tax bracket are paying 13.8%.

Marginal effective tax rates actually paid on income from savings, by bracket

Authors’ calculations using data from the Australian Survey of Income and Housing, 2019. TTPI Policy Report 01-2020

The way forward: a dual income tax system

Our report proposes taxing all types of saving at the same flat low rate.

This dual income tax system (a progressive rate for wages and salaries, a flat rate for income from savings) has been used in Norway, Finland, Sweden and Denmark since the early 1990s. Elements of it are used in Austria, Belgium, Italy, Greece and the Netherlands.

If the rate were 10%

• all interest payments would be taxed at 10%

• all dividends, both domestic and foreign, would be taxed at a rate of 10%

• all capital gains (including owner-occupied housing) would be taxed at 10%

• superannuation contributions would be made from after-tax income and then earnings in the accounts taxed at 10%

• rent and capital gains on investment properties would be taxed at 10%

• the imputed rent from owner-occupied housing (the benefit home owners get from not having to pay rent that is taxed) would be calcuated and taxed at a rate of 10%. An alternative would be to raise the same amount through a broad-based land tax.

Our calculations suggest that if the tax were applied broadly at a rate of 6.2%, it would raise as much as is raised now from taxes on income from savings. If income from owner-occupied housing were excluded, the rate would need to be 10.2%.

But there is no particular reason for the rate to be set to generate as much from savings income as it does now. It could be set to raise more, or to raise less.

The design and implementation of a dual income tax should be considered alongside broader changes to the tax and transfer system. In particular, it should be combined with removing opportunities to re-classify income for tax minimisation purposes. We outline some of the considerations in our report.

In the meantime, as steps towards a flatter fairer system of taxing income from savings, the government could consider better targeting superannuation subsidies, replacing real estate stamp duty with land tax and including the family home in the means tests for pensions and other age-related benefits.

Our current approach to taxing income from savings is a mess at best and a serious driver of intergenerational inequality at worst. Some savings tax arrangements are progressive, taxing higher incomes more heavily, and some are regressive.

We want to encourage and reward savings. But we also need to remove the crazy incentives that impel ordinary Australians to take part in distorting and costly tax planning schemes.

Our report outlines a way forward, and steps to get there.

Investors Brace for Market Moves as Trump Begins Second Term

Investors Brace for Market Moves as Trump Begins Second Term  Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions

Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions  Why your retirement fund might soon include cryptocurrency

Why your retirement fund might soon include cryptocurrency  Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears

Asian Markets Slide as Middle East Conflict Sparks Oil Price Surge and Inflation Fears  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Reliance Industries Surges on Strong Quarterly Profit, Retail Recovery

Reliance Industries Surges on Strong Quarterly Profit, Retail Recovery  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth

Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth  Investors value green labels — but not always for the right reasons

Investors value green labels — but not always for the right reasons  Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand

Gold Prices Rebound in Asia as U.S.–Iran Tensions Support Safe-Haven Demand  Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies

Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies  ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth

ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth  Infosys Shares Drop Amid Earnings Quality Concerns

Infosys Shares Drop Amid Earnings Quality Concerns  U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors

U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors