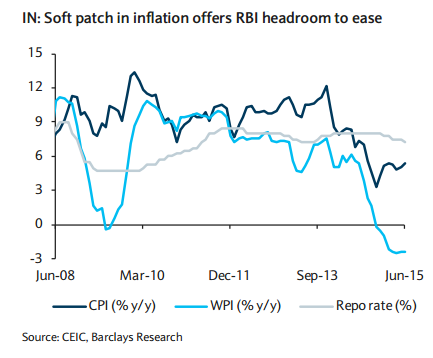

The Reserve Bank of India (RBI) is expected to keep the key policy rates unchanged next week. However, the RBI's monetary policy stance will likely turn softer as the risk of one more repo rate cut in H2 15 is rising. In its previous round of policy announcements in early June, the RBI lowered the repo rate by 25bp, as expected, but maintained a cautious policy stance. The three key risks that the central bank highlighted were: (1) below normal monsoon rains, (2) firming crude oil prices, and (3) volatility in external environment. Developments on most of these fronts are seen since early-June as reassuring.

Cumulative rainfall during June-July stands at 96% of normal, better than the 88% projected by the India Meteorological Department (IMD) for the season (June-September) in earlyJune. Brent crude oil price has softened to c.US$54/barrel currently from c.US$65/barrel in early-June. The eventual liftoff by the US Fed remains an impending external uncertainty. The first Fed rate hike is expected to take place in September. However, given India's generally sound macroeconomic parameters, the impact on India will likely be relatively limited. Accordingly, a case for further easing is expected in the coming months by the RBI.

The monsoon outcome will be largely clear by September and the initial impact of a potential Fed hike - if indeed takes place in mid-September - on INR assets would be visible before the RBI's end-September policy meeting.

"We look to the RBI's commentary and guidance next week to firm our views in this regard. However, given the ongoing soft inflation backdrop, the risk of a 25bp repo rate cut by the RBI in H2 15 is rising, in our view," notes Barclays.

RBI’s policy stance to turn softer

Friday, July 31, 2015 1:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed