New Zealand's data was a softer than markets expected. After the data was released the NZD is seen dropping from 67.0c to 66.5c, while the 2-year swap rate fell 3 basis points.

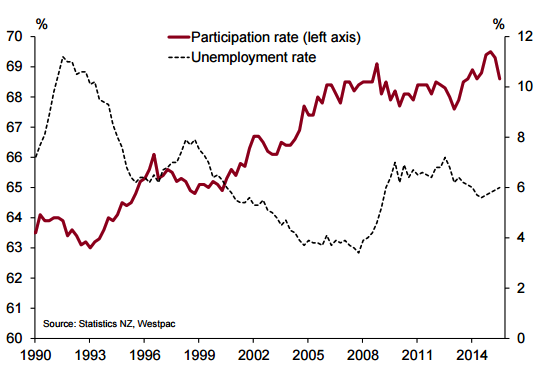

The economy has lost momentum, with a slowdown in GDP growth and hiring. At the same time, both wage inflation and consumer price inflation remain low.

Looking ahead to 2016, New Zealand's economy will face significant headwinds from softening demand conditions offshore, drought conditions domestically, and the levelling off of the Canterbury rebuild.

"The New Zealand's economy is going to need a significant shot in the arm to get inflation back to 2% on a sustained basis. The labour market data reinforces the expectations that the RBNZ will continue cutting the OCR", says Westpac.

RBNZ likely to ease further

Wednesday, November 4, 2015 4:12 AM UTC

Editor's Picks

- Market Data

Most Popular

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty