It may not sound nice but a fact -Chinese authorities have got it all wrong, when it comes to markets. Even after abolishing a USD/RMB peg in way back almost a decade ago, they are still managing it. Making Renminbi move from defacto peg to peg.

Though this managing Yuan, still hasn't blown up to the mangers' face, thanks to cushion of high level of foreign exchange reserve (depleting fast but still at $3.58 trillion), equity market has as a matter of fact.

Authorities' effort to manage the drop in country's equity index, hasn't yield much of a result as China's benchmark stock index, Shanghai Composite is down 40% from June.

Chinese authorities, in their most sincere efforts to micro-manage market has lost more than actual gains.

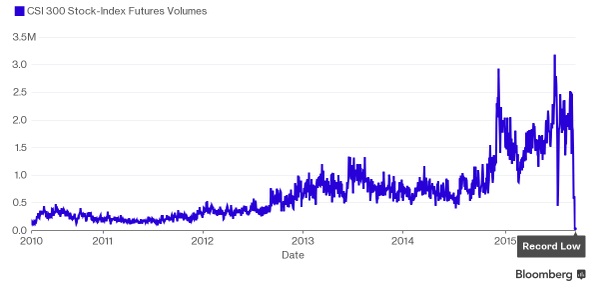

China's most traded blue chip index, CSI 300's futures' market became the biggest in the world by volume, as shown in figure from Bloomberg.

However, Chinese Authorities thought selling future is unpatriotic, and sharpened their probe on companies and fund managers.

Naturally, world's biggest future market drops dead, with volume falling close to nil.

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes