Samsung Electronics Co Ltd (KS:005930) delivered record-breaking revenue and profit in the fourth quarter of 2025, driven largely by booming demand from the artificial intelligence industry for advanced memory chips. The South Korean tech giant reported an operating profit of 20 trillion won (approximately $13.98 billion) for the three months ended December 31, matching its earlier forecast and marking a more than threefold increase from 6.49 trillion won in the same period last year.

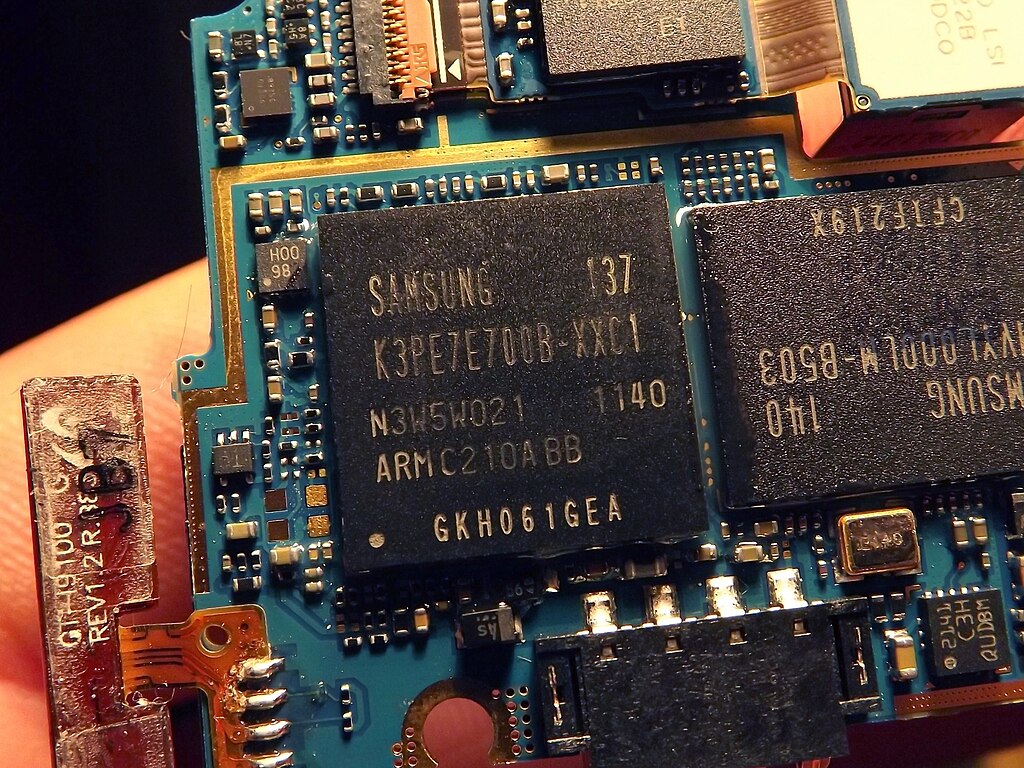

Quarterly revenue surged to an all-time high of 93 trillion won, up from 75.79 trillion won a year earlier. Both revenue and operating profit reached the highest levels in Samsung’s history, highlighting the company’s strong rebound amid a global AI investment wave. The standout performer was Samsung’s memory chip division, which benefited from rising prices and strong margins for high-bandwidth memory (HBM) chips and other advanced processors widely used in AI data centers.

Memory chip prices climbed sharply throughout the fourth quarter and are expected to continue rising in the near term as AI-driven demand accelerates. Advanced memory solutions are a critical component in AI workloads, supporting large-scale data processing and model training. Samsung stated that in the first quarter of 2026, favorable market conditions fueled by the ongoing AI boom are expected to persist, with the company prioritizing high value-added memory products designed specifically for AI applications.

In 2025, Samsung largely closed the technology gap with competitors Micron Technology (NASDAQ:MU) and SK Hynix (KS:000660) in the development and mass production of advanced HBM chips. The company also secured a major data center agreement with AI startup OpenAI, involving chip supply and the construction of AI-focused data centers in South Korea. Additionally, recent reports indicate Samsung plans to begin producing advanced HBM chips for NVIDIA Corporation (NASDAQ:NVDA) as early as February.

Robust chip performance helped offset weaker demand in Samsung’s smartphone, display module, and camera sensor businesses during the quarter, underscoring the strategic importance of AI-driven semiconductor growth to the company’s future outlook.

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race

Nvidia Confirms Major OpenAI Investment Amid AI Funding Race  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil