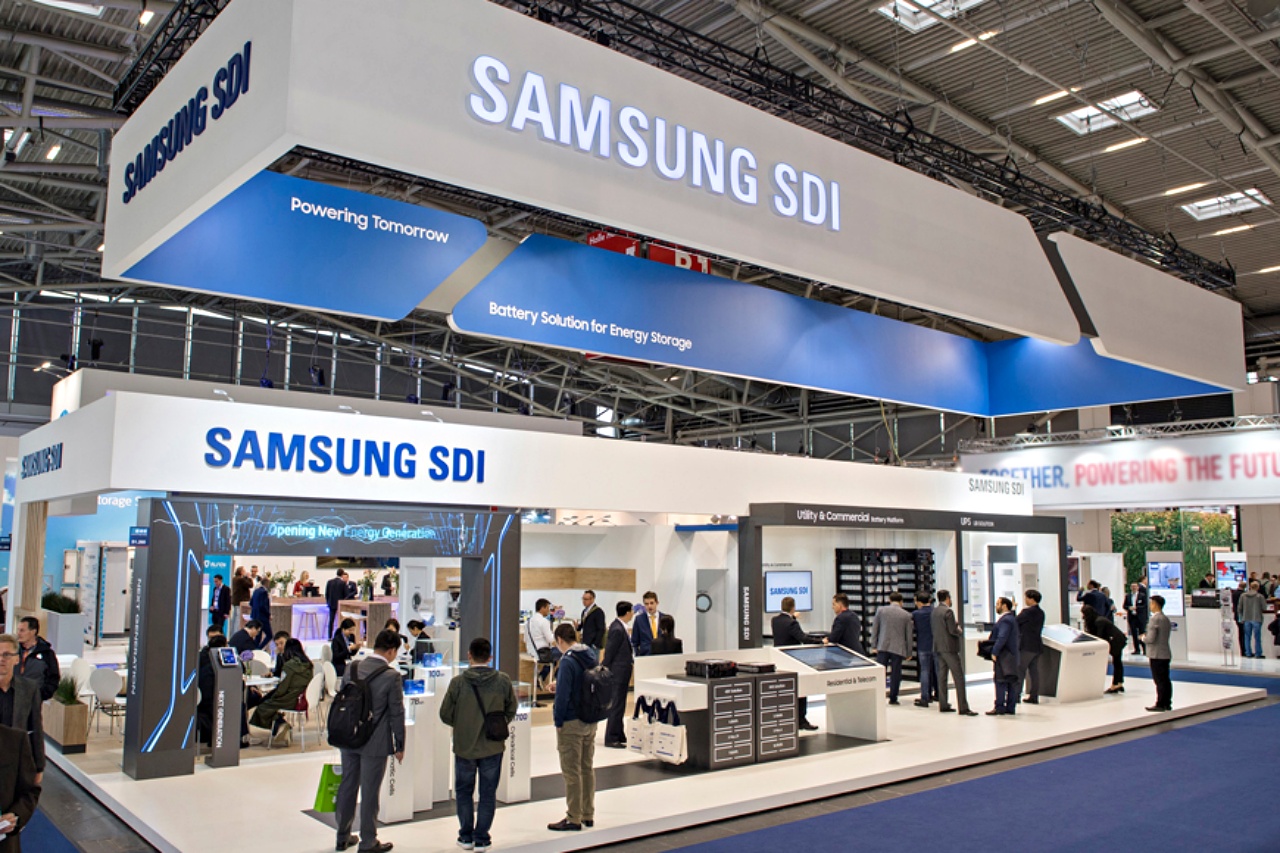

Samsung SDI announced that its U.S. subsidiary, Samsung SDI America, has signed a multiyear agreement to supply lithium iron phosphate (LFP) batteries to a major U.S.-based energy infrastructure company. The deal, valued at more than 2 trillion won (approximately $1.36 billion), marks a significant step in the company’s strategy to expand its footprint in the fast-growing energy storage system (ESS) market. Deliveries under the contract will begin in 2027 and continue for three years, reinforcing Samsung SDI’s long-term commitment to supporting clean energy solutions in the United States.

Although the customer’s identity was not disclosed, Samsung SDI described the partner as a leading developer and operator of energy infrastructure. The announcement sparked strong investor interest, with Samsung SDI shares climbing as much as 6.1% in morning trading, even as the KOSPI index slipped 0.1%. The surge reflects market confidence in the rising demand for ESS batteries, especially as global data centers, renewable energy projects, and grid stabilization efforts require more efficient and reliable storage solutions.

The LFP batteries involved in the contract will be produced using converted prismatic cell production lines at Samsung SDI’s U.S. facility. This shift aligns with the company’s broader strategy to adapt its manufacturing capabilities in response to evolving market conditions, including the transition away from certain U.S. subsidies for electric vehicle batteries. By repurposing EV battery production equipment for ESS applications, Samsung SDI aims to strengthen its competitiveness and capture new opportunities in the energy storage sector.

Samsung SDI, which already operates a joint venture EV battery plant with Stellantis in the United States, emphasized that ESS batteries share similar chemistry with automotive batteries, making the production transition efficient. As demand for renewable energy storage continues to grow, the company is positioning itself as a key supplier for next-generation power infrastructure.

Lindt Posts Record CHF 5.92 Billion in Sales for 2025, Doubles Share Buyback Program

Lindt Posts Record CHF 5.92 Billion in Sales for 2025, Doubles Share Buyback Program  Pentagon Labels Anthropic AI a Supply-Chain Risk, Restricting Use in U.S. Military Projects

Pentagon Labels Anthropic AI a Supply-Chain Risk, Restricting Use in U.S. Military Projects  Domino's Pizza UK Reports 15% Drop in Annual Profit Amid Weak Sales and Rising Costs

Domino's Pizza UK Reports 15% Drop in Annual Profit Amid Weak Sales and Rising Costs  Air New Zealand Raises Fares as Middle East Conflict Drives Jet Fuel Prices Higher

Air New Zealand Raises Fares as Middle East Conflict Drives Jet Fuel Prices Higher  Tanzania’s economy: Strong Foundations, Positive Indicators

Tanzania’s economy: Strong Foundations, Positive Indicators  Amazon Engineers Investigate AI-Linked Outages as GenAI Coding Tools Raise Reliability Concerns

Amazon Engineers Investigate AI-Linked Outages as GenAI Coding Tools Raise Reliability Concerns  FAA Issues Ground Stop for JetBlue Airways Flights Across All Destinations

FAA Issues Ground Stop for JetBlue Airways Flights Across All Destinations  Nvidia Sets $4M CEO Bonus Target for Fiscal 2027 as AI Demand Drives Revenue Growth

Nvidia Sets $4M CEO Bonus Target for Fiscal 2027 as AI Demand Drives Revenue Growth  Chinese Electric Freight Trucks Are Disrupting Europe's Market in 2026

Chinese Electric Freight Trucks Are Disrupting Europe's Market in 2026  Yann LeCun's AI Startup AMI Raises $1 Billion at $3.5 Billion Valuation

Yann LeCun's AI Startup AMI Raises $1 Billion at $3.5 Billion Valuation  Foxconn Sees Strong Growth Ahead Despite Limited Impact From U.S.–Israel–Iran Tensions

Foxconn Sees Strong Growth Ahead Despite Limited Impact From U.S.–Israel–Iran Tensions  Denso Reportedly Bids $8.2 Billion to Acquire Rohm in Major Japanese Semiconductor Deal

Denso Reportedly Bids $8.2 Billion to Acquire Rohm in Major Japanese Semiconductor Deal  SoftBank Seeks Up to $40 Billion Loan to Fund Major Investment in OpenAI

SoftBank Seeks Up to $40 Billion Loan to Fund Major Investment in OpenAI  Shell Signs Oil and Gas Agreements With Venezuela to Advance Dragon Gas Project

Shell Signs Oil and Gas Agreements With Venezuela to Advance Dragon Gas Project  Anthropic Sues Pentagon Over AI Blacklist, Citing Free Speech Violations

Anthropic Sues Pentagon Over AI Blacklist, Citing Free Speech Violations  Treasury Secretary Scott Bessent Slams JPMorgan Report on Gulf Oil Insurance as ‘Completely Irresponsible’

Treasury Secretary Scott Bessent Slams JPMorgan Report on Gulf Oil Insurance as ‘Completely Irresponsible’  FDA Biologics Chief Vinay Prasad to Leave Agency in April Amid Policy Disputes

FDA Biologics Chief Vinay Prasad to Leave Agency in April Amid Policy Disputes