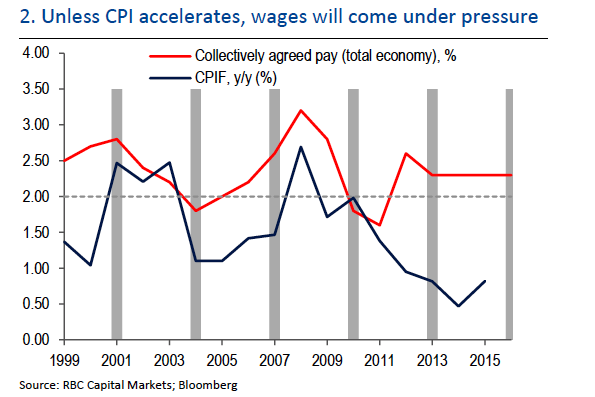

The Riksbank wants to see is EUR/SEK staying at its current levels of 9.30, given the emphasis put on SEK in supporting the CPI recovery. A rise in import prices via SEK devaluation is likely the quickest and most direct route towards increasing CPI back to the Riksbank's target of 2%, given the limited timing, as the 2016 wage negotiations come into focus and the lag effect of monetary policy on general price levels.

"This asymmetry suggests greater upside risk for EUR/SEK and the EUR/SEK is forecasted at 9.60 by year-end 2015 and Q1 2016 before seeing a gradual grind lower", noted RBC capital markets.

Sweden 2016 wage negotiations round in focus

Thursday, July 9, 2015 9:45 AM UTC

Editor's Picks

- Market Data

Most Popular

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security  KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally

KOSPI Surges Over 12% as South Korean Stocks Rebound on Chipmaker Rally  EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy  U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth

ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth  Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility

Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears  China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength  Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions

Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions