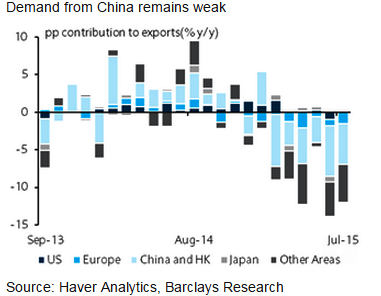

Taiwan exports again posted negative growth rate of -13.9% in June which recorded -3.8% in May. Consensus expected the economy's exports to drop by 10.5% due to a significant fall in refinery and petrochemicals shipments - mainly to China.

The quantum of the decline suggests that volumes have fallen as well, in addition to prices. That said, on a seasonally adjusted basis m/m, exports did manage to climb 2.5% m/m, which partly reversed the 6.7% drop in June. Barclays notes, at a disaggregate level, shipments of chemicals, mineral products and plastic plummeted 30.2% in July, steeper than the 21.4% drop in the first half of 2015 (2014 H1: -3.7%).

Excluding these three categories, exports would have fallen only 6.9% in July, an improvement compared to the 12.6% drop in June (May: -2.3%; Apr: -7.6%), indicating that the drag from external demand may be lessening. An important silver lining is that electronics was much less a drag on overall exports in July than in June - a sign that activity levels may have bottomed out and that the supply chain is rebuilding ahead of new launches.

Barclays argues, "Production and exports are likely to recover modestly from Q3, helped by destocking of inventory and ramping up of production ahead of new launches. Therefore, CBC is expected to stay on hold at its September meeting. With the weaker growth outturns, we have pushed back our rate normalisation forecast by two quarters and now expect the CBC's first rate hike of 12.5bp in June 2016."

Taiwan exports start Q3 on weak note

Tuesday, August 11, 2015 4:49 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed