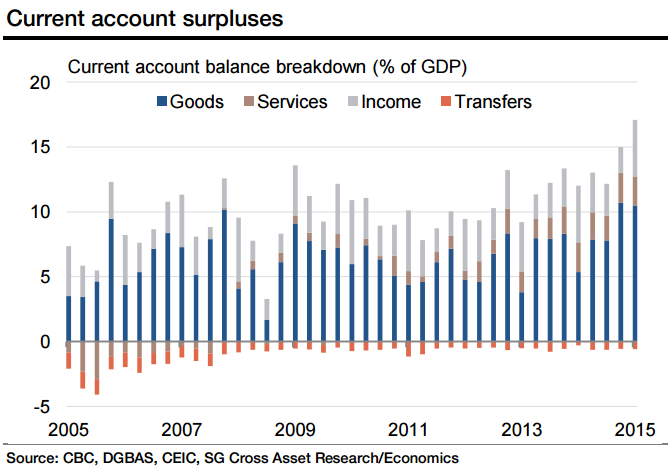

Taiwan's current account surplus rose strongly to 16.8% of GDP in Q1 2015 from 14% in Q4 2014. Surges in the trade surplus alone contributed around 3pp to the increase, thanks to sharply reduced commodity import prices. The trade surplus remained sizeable at USD12.4bn in Q2 after USD13.4 in Q1, pointing to another big current account surplus. In fact, Taiwan's recent current account surpluses (>10% of GDP) were more than doubled the level during 2008 financial crisis.

The latest data shows Taiwan has the second-largest current account surplus relative to GDP among Asian economies. The current account surplus is likely to see a reduction in H2 as the impact of low oil prices fades on nominal import values. But even so, the annual surplus is still seen reaching 10% of GDP - one of the highest in the world.

"Our forecast of a still sizeable current account surplus is based on the expected strengthening of global demand, which is the very opposite of 2008," says Societe Generale.

Indeed, one of the key supports for the Fed's lift-off is sustained above-trend growth of the US economy. The expected recovery in external demand led by the US bodes well for a recovery in export growth.

Taiwan's current account surplus is sizeable and likely to remain so

Monday, August 17, 2015 11:44 PM UTC

Editor's Picks

- Market Data

Most Popular

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion