Once you have made the decision to diversify into a hard asset, the first decision becomes which form of gold should I own, Bullion Bar or Coins? All precious metals have a myriad of costs that are associated with their production and delivery to the consumer. For this reason I’ve outlined the major factors involved in creating what is call the premium, which is the charge over the “spot price”, to the end user.

Here are the factors that contribute to coins and bullion bars that denote the premium over the spot price, and I hope this lends some clarity to this broader side of the metals market.

- Fabrication costs (mining, smelting, casting and

- Packaging costs, with weighting and quality inspection

- Administration costs

- Security costs

- Storage costs

- Marketing

- Sales staff

- Insurance

- Transportation/shipping expenses

- Profit margin is figured into all the steps of the supply chain

Coins have the highest premium, as the most fabrication work goes into their creation, and bars have the lowest premium. For these reasons I’m covering the most inexpensive means to buy and hold gold. Just remember, this also means that when you sell the gold back to a dealer, the premium you receive will be less.

Bullion bars were first cast by the Royal Treasury of Egypt during the ancient Egyptian Pharaohs’ era, by digging an oblong trench in the sand and pouring the molten metal into the sand. This was the creation of the technique called “sand casting” and was used for bullion bar ingot gold creation for the Royal Treasury of Egypt from 3150 B.C. - 30 B.C. The Romans then came along and truly refined both the shape and size of not only bullion bars but coins as well. Still, the early sizes were obviously somewhat erratic by modern standards, but their scales helped them hone the accuracies in the sand castings’ final steps. By contrast, today’s ingots are very exacting with one troy ounce defined as exactly 31.1034768 grams. New scientific innovations in tools for cutting, casting and weighting allow me to offer you a myriad of shapes and sizes from 1 gram all the way up to 400 ounce bars, referred to as “Big Boys” in the metals industry.

Now let’s add some clarity to making that final decision as to which manufacturers you should buy your Gold Bar Ingot from, as it can be confusing with all the choices that are available to you. Also at this point I want you to understand just what a Hallmark is, that stamped symbol in a bullion bar, as it tells a dealer just will they buy back from you in the future. The Hallmark is made up of several elements. The stamped or “struck” mark denotes the type of metal and purity, the maker/sponsor's mark and the year of the marking. I want all my readers to be very clear on this point, I believe that you should never buy a bar that doesn’t have a Hallmark stamped on it that can’t be confirmed by the company that manufactured it. For this very reason I have a certain affinity for Swiss bars, because when you go to resell them, you might not have to have them reassayed at a cost. Of course, you pay slightly more for a good Hallmark, but as you can better understand now, it is worth it in the long run.

In 1424 in France, Jean de Brogny, after having consulted with a council of eight Master Goldsmiths from Geneva, enacted a regulation on the purity and hallmarking which still stands today. So after a few centuries I can get a little more comfortable with the competency of the manufacturer, and for this reason, I have a proclivity to use Swiss gold. In today’s modern age you can now scan the QR code on a bar’s packaging, and the company will confirm its their bar, clever littler bankers.

I hope that you now have a better fundamental understanding of bar bullion. In the next few closing lines I’ll try to give you some idea of what you might expect to pay on the open market for bullion bars of one ounce or greater in size.

It is important to remember that gold is a currency and the exchange of one currency for another is a non-taxable event in most transactions. China has three kinds of taxes, namely, Value-Added Tax, Consumption Tax and Business Tax. The levy of these taxes are normally based on the volume of turnover. Forty seven states have no sales tax on gold in the U.S., the exceptions are Minnesota, Texas, and California, and these States have a small tax fee, so it is always best to check your local state’s taxable status on gold before you buy it, as all tax laws are subject to change. Now I hope you have a little better understanding of why Ingot bars cost what they do, when and how they are made, and who has the most recognizable product.

A cost-effective purchasing method works like this for your bar accumulations: Get the London Fix price. There is a morning and afternoon “Fixing” price that is published all over the world and freely accessible. Depending on the time and market movement, multiply by 1.6% and you should have your cap for the price that you should expect to pay for top quality bullion bars. Remember that demand will raise or lower the premium price that you will end up paying.

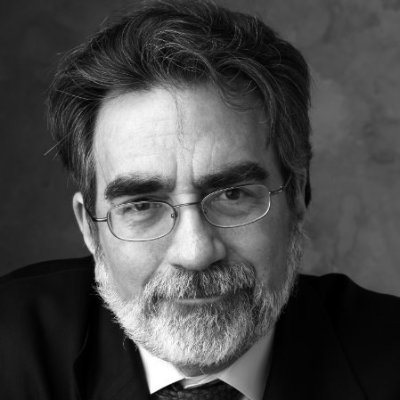

Peter Thomas is a Senior Vice President at the Zaner Precious Metal Division and is viewed as one of the leading authorities in the global metals markets. As a former licensed Floor Broker he was a “filling broker” in the silver pit back in the days when silver ran from $5.00 to $55 an ounce. He currently manages a global cash desk which handles Refiners, Recyclers, Mining Operations and Coin & Bullion companies. He is constantly in demand for his insightful opinions drawn from his 35 years of metals trade to such news companies and magazines publishers as Bloomberg News, The Guardian, Hard Assets, Kitco and EconoTimes. You can follow him on twitter at @goldbug111 & @ZanerMetals or reach out to him at, (312) 277-0140 & email [email protected].

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed