Trade Idea EURUSD (Intraday)

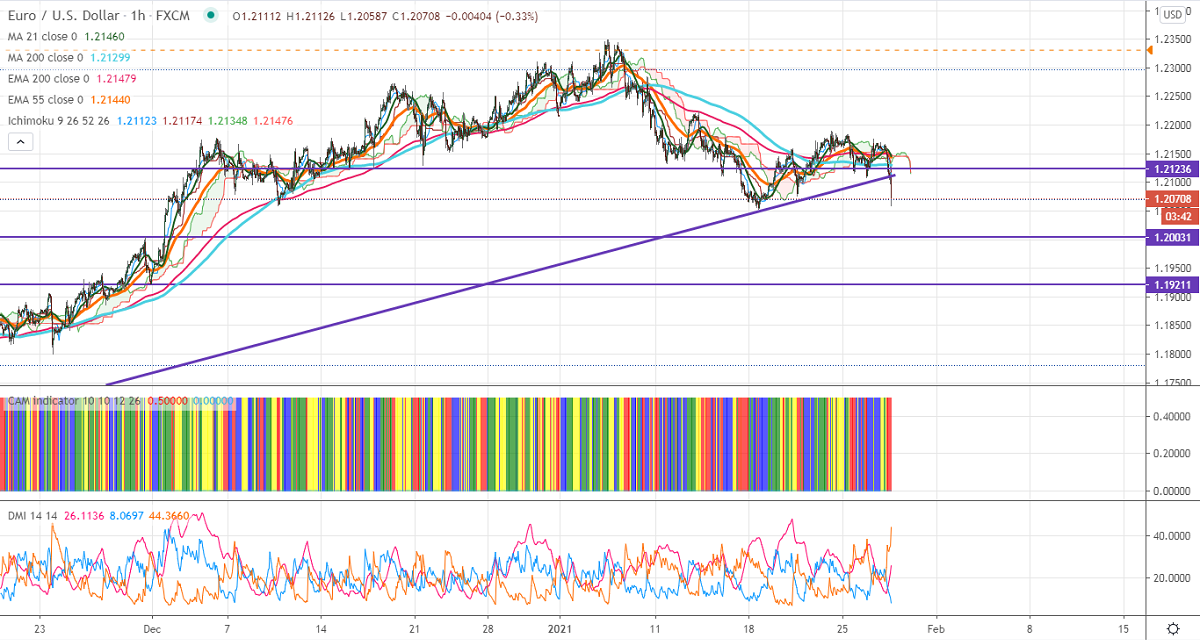

Ichimoku analysis (1-hour chart)

Tenken-Sen- 1.21320

Kijun-Sen- 1.21370

EURUSD declined more than 100 pips after dovish comments by ECB member Knot. He said that the central bank will take necessary action if the euro appreciates further. US durable goods orders rose to 0.2% in Dec well below expectations of 1.2%. The pair hits an intraday low of 1.20583 and is currently trading around 1.20700.

Technical:

On the higher side, near-term resistance at 1.21150 (support turned into resistance). Any indicative violation above targets 1.2180/1.2200/1.2260. The next support is around 1.21150. Breach below will drag the pair down till 1.2050/1.200.

It is good to sell on rallies around 1.21180-20 with SL around 1.2160 for the TP of 1.2000.