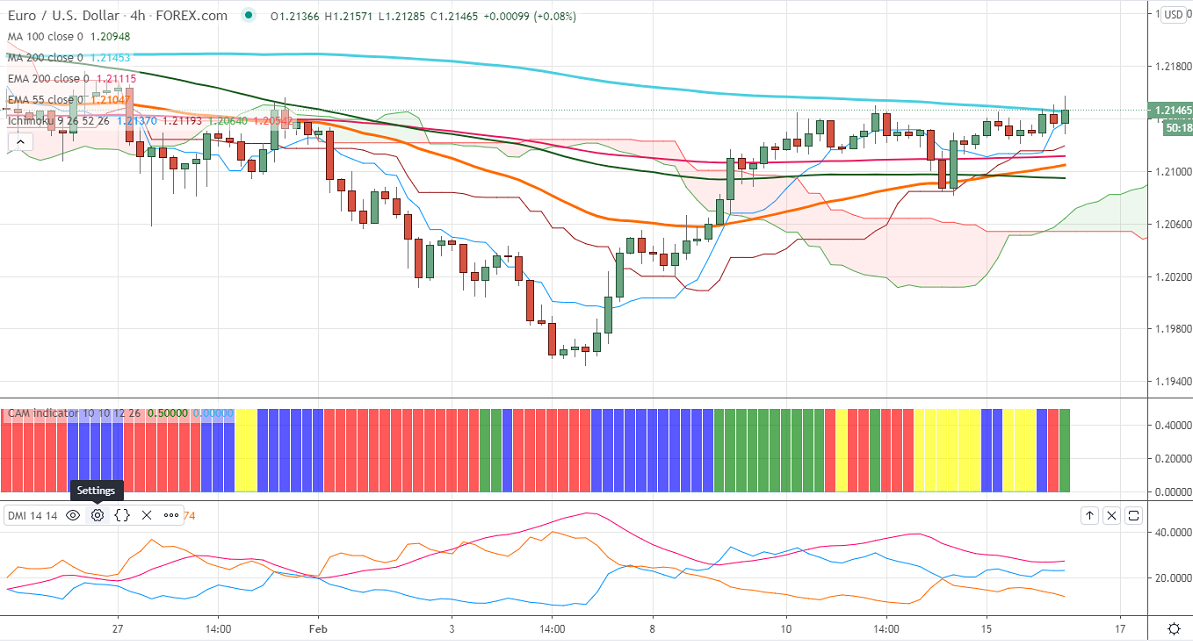

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.21318

Kijun-Sen- 1.21159

EURUSD is trading higher and holding above 1.21500 on upbeat market sentiment. The Coronavirus vaccination rollout, declining new COVID-19 cases and hopes of more US stimulus are putting pressure on the US dollar index at higher levels. DXY is trading weak, any violation below 90 confirms bearish continuation. It has surged more than 10% in past one week. EURUSD hits an intraday high of 1.21571 and is currently trading around 1.21480.

Technical:

The pair is trading slightly above 200-4H MA. It confirms minor bullishness, a jump till 1.2200/1.2260 likely. The near-term support is around 1.2080. Breach below will drag the pair down till 1.2050/1.2000/1.19550/1.1900.

It is good to buy on dips around 1.2128-30 with SL around 1.2080 for the TP of 1.2260.