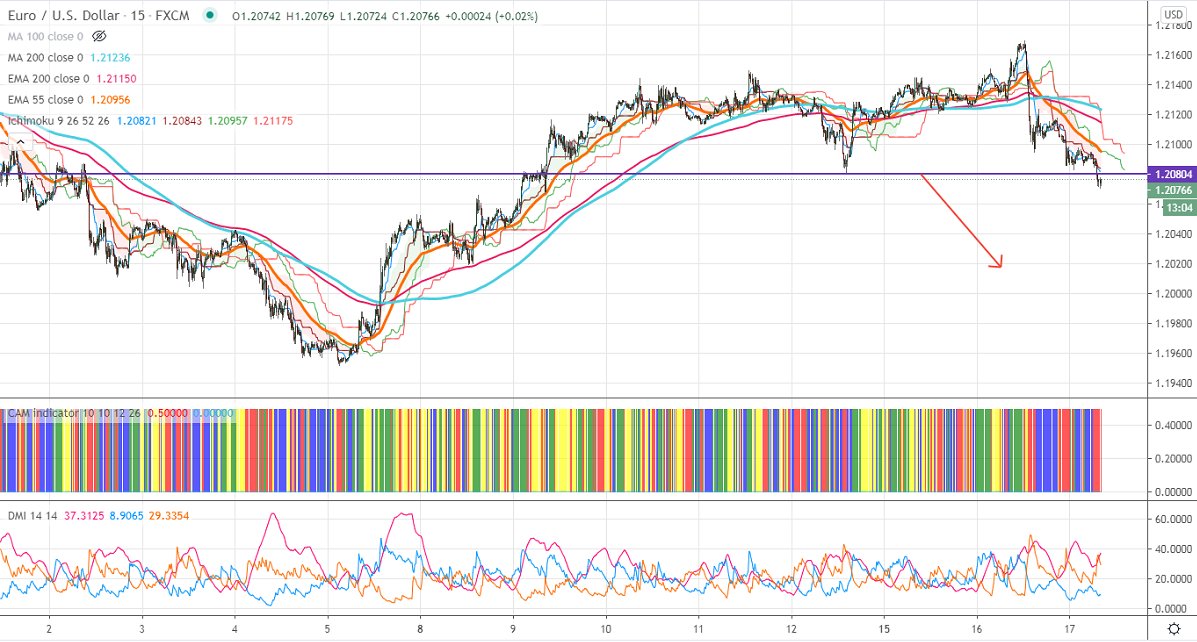

Ichimoku analysis (15 min chart)

Tenken-Sen- 1.20843

Kijun-Sen- 1.20823

EURUSD is trading weak after a minor pullback till 1.21695 on broad-based US dollar buying. The pair breaks significant support 1.20800 and is trading slightly below that level. The major jump in the US 10- year yield is also supporting the US dollar index at lower levels. Markets eye US retail sales data and Fed's meeting minutes for further direction. DXY is trading higher; any violation above 91 confirms bullish continuation. EURUSD hits an intraday low of 1.20719 and is currently trading around 1.20723.

Technical:

The pair is trading slightly above 200-4H MA. It confirms minor bullishness, a jump till 1.2200/1.2260 likely. The near-term support is around 1.2080. Breach below will drag the pair down till 1.2050/1.2000/1.19550/1.1900.

Indicator (15 min chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around 1.2080-825 with SL around 1.21250 for the TP of 1.2000.