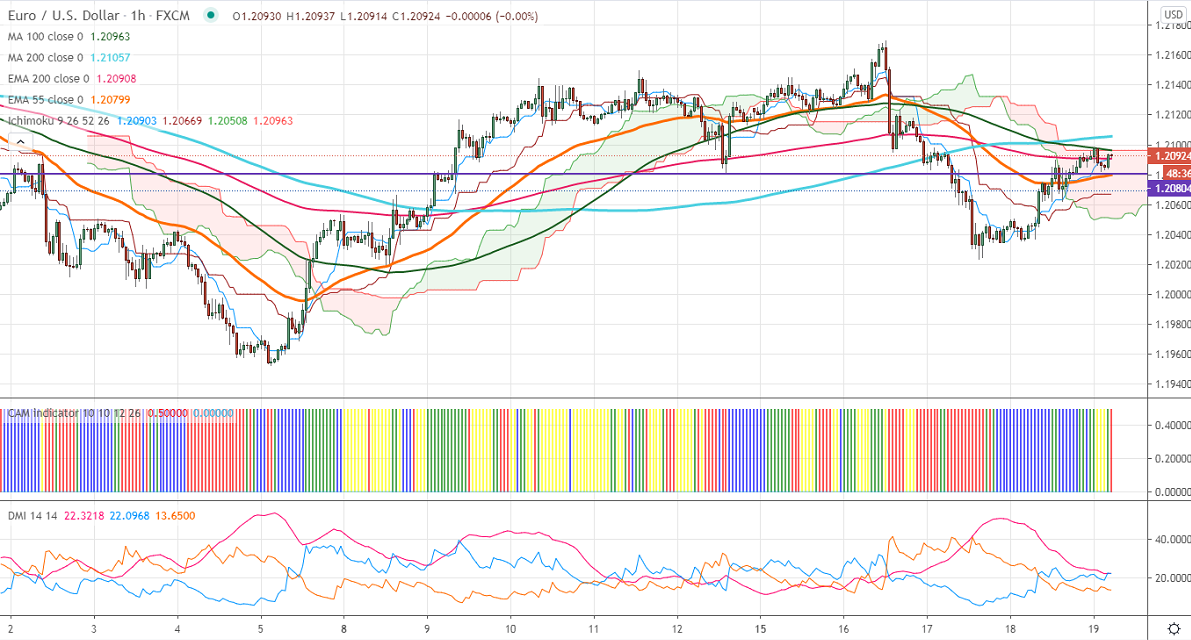

Ichimoku analysis (60 min chart)

Tenken-Sen- 1.20903

Kijun-Sen- 1.20669

EURUSD recovered more than 80 pips from a low of 1.20231 on broad-based US dollar selling. The Single currency recovered despite sell-off in global markets. The hopes of more stimuli from the US and European central bank are putting pressure on the US dollar at higher levels. The number of people who have filed for unemployment benefits rose to 861000 in the week ended Feb 13 compared to a forecast of 775K. US building permits rose by 10% while housing starts plunged by 6%. DXY is struggling to close above 91 levels, bullish trend continuation only above 91.60. EURUSD hits an intraday low of 1.20940 and is currently trading around 1.20918.

Technical:

The pair is trading slightly below 200-H MA. Any break above 1.21060 confirms minor bullishness, a jump till 1.2160/1.2200/1.2260 likely. The near-term support is around 1.2080. Breach below will drag the pair down till 1.2050/1.2000/1.19550/1.1900.

Indicator (60 min chart)

CAM indicator – Bullish

Directional movement index – Bullish

It is good to sell on rallies around 1.2105-60 with SL around 1.2160 for the TP of 1.2000.