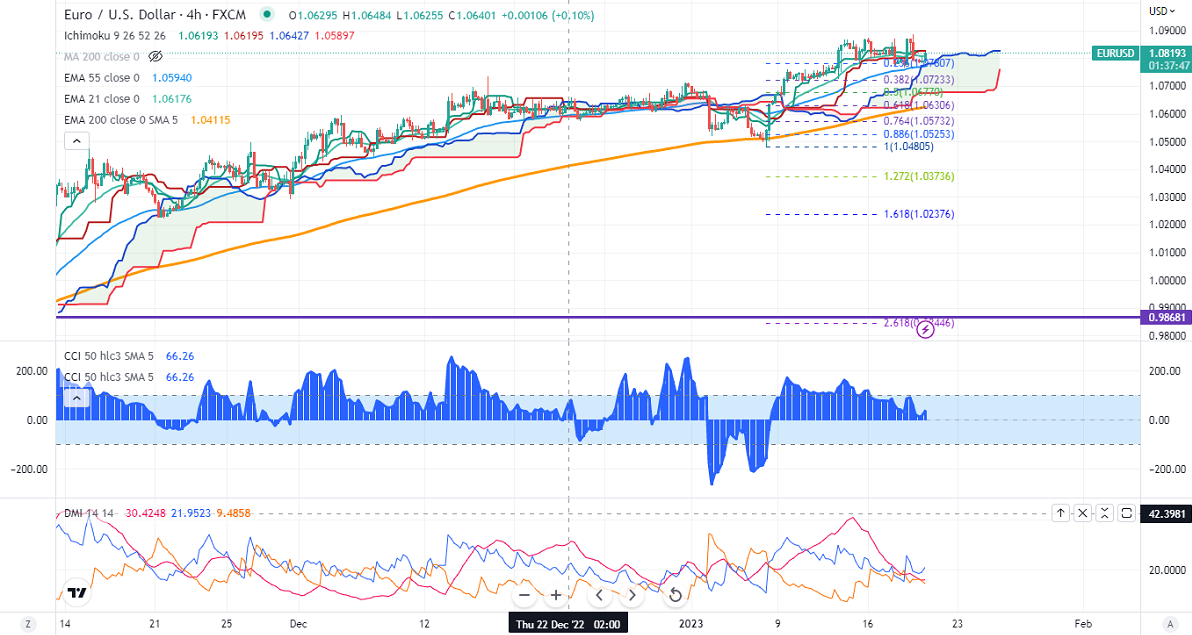

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.08267

Kijun-Sen- 1.08267

EURUSD trades in a tight range between 1.08873 and 1.07660 for the past week. The US dollar lost its momentum after weak US economic data. . The US Producer price index declined 0.50% last month, below the estimate of 0.10%. The yearly PPI came at 6.2% vs. an estimate of 6.8%. US retail sales came at -1.1% last month, the biggest drop since Dec 2021. Markets eye US Unemployment claims and Philly fed manufacturing index for further direction. It hits an intraday high of 1.08241 and is currently trading around 1.08170.

Technical:

The pair is trading below short-term (21 and 55 EMA) and above long-term (200-EMA) in the 4-hour chart. Any break above 1.08750 confirms minor bullishness, with a jump till 1.0925/1.09500/1.100 likely. The near-term support is around 1.07600. The breach below will drag the pair down to 1.0700/1.0660/1.0600.

Indicator (4-hour chart)

CCI – Bullish

Directional movement index – Neutral

It is good to buy on dips around 1.0800 SL around 1.0760 for the TP of 1.100.