The breakdown of euro-area Q1 GDP should confirm that the 2015 cyclical recovery is mainly being driven by consumption.

In fact, in recent years, until now there has been only one sustained period where long rates mattered more than short rates in driving EUR/USD and the correlation to the box spread in the lower panel of 2nd figure inverted.

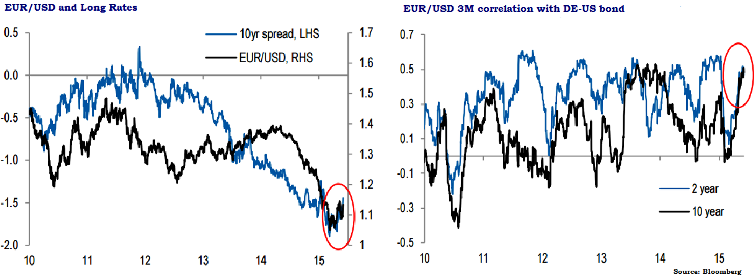

As shown in the 1st figure since core European bond yields troughed in mid-April, EUR/USD has moved in lock-step with the DE-US long-term rate spread, including through last week's 400 points rally/20 bps spread widening.

Given that this week's long end widening has had no counterpart at the front end of the curve, might this be a reason to question the sustainability of the EUR/USD rally? Among other factors, we think it is. Yet when we have looked at the relationship between FX returns and rates in the past, we have found that short rates consistently trump long rates as a determinant of returns.

Figure 2 puts the recent relationship between EUR/USD and the 10yr spread into historical context, comparing the correlation with EUR/USD to the same correlation for 2yr spreads (daily, all calculated in first differences).

In the latest three months, the correlation for 10yr spreads is almost identical to that for 2yr spreads (0.48 compared to 0.47), and if we shorten the window to a one-month correlation, the correlation for long rates is much higher (0.52 compared to 0.35).

Looking back through the last five years, however, it is clear that it is highly unusual for the FX correlation to long rates to be either as high as it is now, or higher than that for short rates.

Treasury bond yields and their correlation with FX returns

Monday, June 8, 2015 6:52 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings