The rising global risks have dented arguments for a more hawkish assessment from BoE. Rate markets have now pushed back BoE rate hike pricing. Until a month ago, sterling money markets were pricing in a hike around the beginning of next year, whereas the earliest they now expect the BoE to move is around April or May. With no chance of a hike seen on Thursday, focus will be on the minutes and how rate-setters who split 8-1 against a hike in August voted.

"Governor Carney has stressed that the timing of the central bank's first move will begin to come into focus around the end of the year but, as fundamentals currently present themselves, we do not expect a majority vote in favour of a rate hike until May 2016", says Rabobank in a research note to its clients.

Like all other central banks, the BoE will be carefully evaluating the impact of China's economic slowdown and increased market volatility on the UK economy. While these factors could be sufficient to steady the hands of some of the MPC hawks in the next couple of months, it seems possible that three members of the committee could be voting for an immediate rate hike by the end of the year. That said, last month the BoE revised down its inflation forecasts and, in view of weak commodity prices, it could still be some time before CPI inflation returns to the Bank's 2% target.

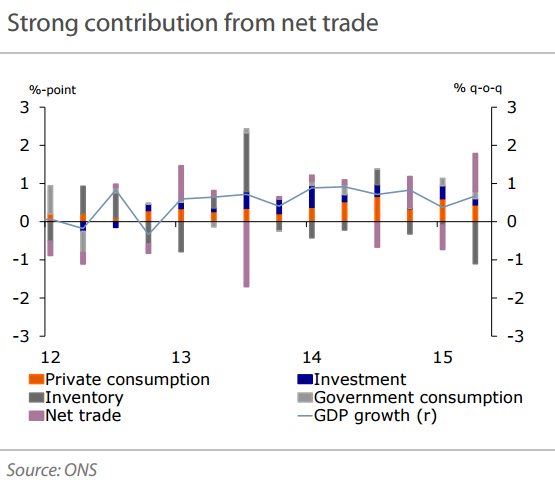

Data last week showed that Britain's dominant services sector grew at its weakest pace in over two years in August. The second estimate of UK Q2 GDP confirmed that the British economy expanded by 0.7% q/q in the second quarter of 2015. All components, except inventory formation, contributed positively. Latest data also showed British wages excluding bonuses rose by 2.8 percent in Q2, the biggest annual real-terms rise since mid-2007, while total employment edged down from the first quarter's record high. On average, nominal wages increased by 2% over the last year, while labour productivity all but stagnated in 2014 (+0.1%).

Private consumption grew by 0.7% q-o-q in the second quarter of 2015 and is expected to continue to grow in the second half of the year. Households still profit from past nominal wage increases and low commodity prices. The increase in consumer confidence in August supports the expectation of continued real household spending in the third quarter. That said, the survey was conducted between August 1 and August 15, and therefore does not include the possible effects of the recent financial market turmoil due to China's devaluation and disappointing economic growth figures. But since the relationship between consumer confidence and equity prices is relatively weak, the recent turmoil will probably have limited impact on household consumption.

"For 2016, however, we expect a slowdown of households' spending growth as inflation will probably increase, unless commodity prices decrease even further. Further more, employment growth will probably slow down, as the catching-up after the financial crisis is coming to an end", notes Rabobank.

Sterling pulled away from a four-month low against the dollar on Monday but was still almost 4 percent lower than two weeks ago, with investors having pushed back their bets on BoE interest rates hikes until well into next year. It was half a percent higher against the dollar on Monday at $1.5252, and was also half a percent up versus the euro at 73.16 pence.

UK household consumption likely to slowdown in 2016, rate hike unlikely until May 2016

Monday, September 7, 2015 10:28 AM UTC

Editor's Picks

- Market Data

Most Popular