Long-dated forward rates have rallied to historic lows, and the curve has flattened aggressively. Fading the long end is always risky and best expressed via cross-market shorts versus Europe or forward curve steepeners out to the 30y sector.

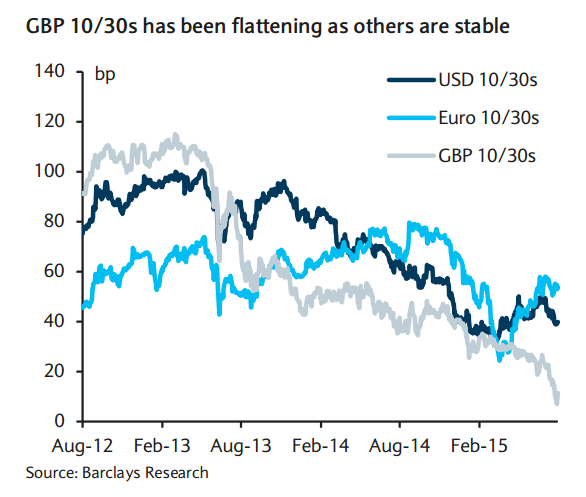

To paraphrase and juxtapose Jane Austen and Maynard Keynes, it is a truth universally acknowledged that the long end of the GBP curve can remain irrational longer than many can remain solvent. Long-dated forwards in the gilt and swap spaces have touched historic lows as a fresh wave of stops has been triggered by shorts having to "stop in". This week's IL58 auction cleared at -0.929%, a record low for long-dated gilt supply. The GBP curve has flattened sharply this year, with GBP 10/30s touching a cycle low while other markets have not flattened as aggressively. As a result, this has left the 10/30s boxes at rich levels. While the GBP/USD box at -29bp is still some 10bp from the lows seen in early 2014, the GBP/Euro box at -42bp is at a historical low.

A number of factors have been offered as to why long-dated forwards have rallied to new lows. Most notably, it is the ultra-long forwards (ie, post-30y) that are at their most extreme levels. The most obvious explanation has been LDI flow from liability hedging schemes. Contemporaneous data are hard to come by, yet anecdotal evidence suggests there has not been a step up in activity, so the recent richening has been exacerbated by typically poor summer liquidity. In its latest survey of the LDI universe5 , KPMG estimates that the number of LDI mandates has increased by more than 200 in 2014 to 1,033, with about £660bn of scheme liabilities hedged via LDI (total liabilities on a buyout basis are estimated to be about £2,000bn). Interestingly, the survey suggests that 30% of schemes with LDI mandates have triggers to extend LDI coverage and that there has been an increase in triggers migrating from a yield-based to a time-based strategy, which takes a phased approach to implementation.

UK rates: Weekly review

Friday, August 14, 2015 12:58 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed