Last unemployment report before the Article 50 is triggered, will be published today, however, today’s report may not be a major market mover for the pound but rather work as a support for all pound based pairs, as the focus remains on the inflation, which is now hovering just below 2 percent (Bank of England’s target), upcoming Brexit negotiations, and on the fallouts from the Dutch elections.

One of the key measures of economic well-being is the unemployment report, which will be released from the United Kingdom today at 9:30 GMT. The reports released so far have shown no devastating impact from the referendum outcome. For today, the expectations are similar.

Below is the preview of the report -

- As of now, the unemployment rate in the UK stands at 4.8 percent and median estimate suggests it is likely to remain unchanged.

- So, the major focus will be on earnings growth, since that will be the measure of economic wellbeing.

- Moreover, a positive wage growth should help to downsize the fear of slow down in the economy heading towards Brexit negotiations. It will be nice evidence that companies are ready to increase wages even in the face of an exit from the European Union. BoE governor Carney said that the central bank would be monitoring the level of income closely, especially since the recent upbeat economic performance was due to consumer spending and credit. Income levels directly affect these two components.

- Recently, there has been some weakness in the economic dockets such as the housing reports and the PMI reports. So, the market participants would be closely watching whether the earnings report reflect the same or not.

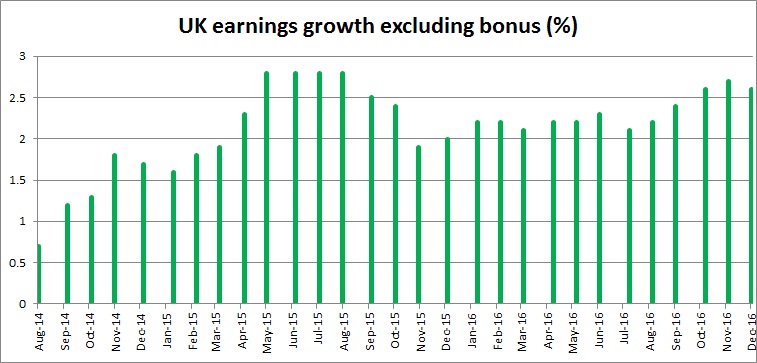

- After declining since October 2015 from 2.8 percent, wage growth has dropped to just 1.8 in February last year but recovered since then. Last month, earnings grew by 2.6 percent both excluding and including the bonus.

- Today earnings growth is expected to be at 2.4 percent including bonus and by 2.5 percent excluding it.

It is likely to provide support to the pound based pairs if the data comes better than expected or even come in line with expectations. However, we don’t expect the data to change outlook materially. The pound is currently trading at 1.222, up 0.55 percent so far today.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed