UK mortgage data tell us that the level of housing transactions is growing only very slowly, despite generally supportive financial conditions and economic environment. One of the reasons seems to be a lack of supply.

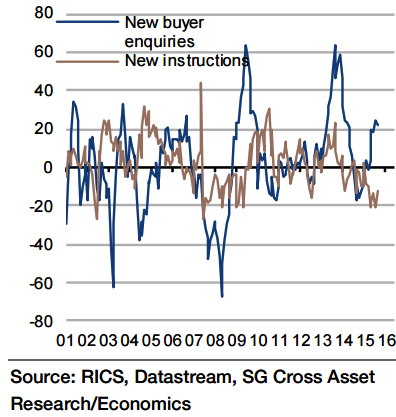

The RICS survey is telling clearly that the supply of properties onto the market is not growing, despite a strong increase in the level of buyer enquiries. This supply problem likely stems from constraints in the housing construction pipeline and a lack of attractive deals for remortgaging existing properties.

"The RICS survey is expected to repeat this story with clear excess demand remaining which will also show up in a rising RICS price index", says Societe Generale.

UK's housing supply-demand imbalance continues

Wednesday, October 7, 2015 5:38 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed