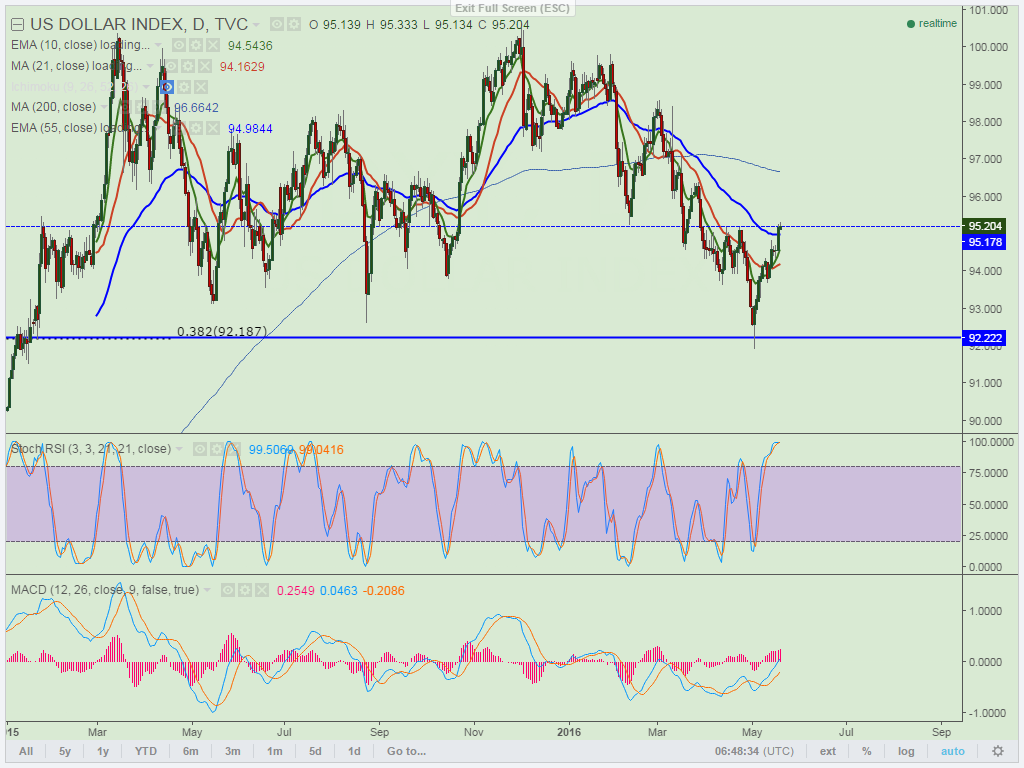

- Major resistance- 95.20 (Apr 14th 2016)

- Major support – 94.10 (21 day MA)

- US Dollar index has surged overnight on the modestly hawkish FOMC minutes increased hopes of rate hike in June.

- Fed fund futures shows that investors also pushed the odds of June rate hike to 34% sharply for 4% this week.

- DXY breach of 95.19 confirms minor trend reversal .Break above 95.20 will take the index till 95.85/96.40.

- On the lower side minor support 94.70 (4H Kijun-Sen) and any break below targets 94.10 (21 day MA)/93.60.

It is good to buy at dips around 94.70 with SL around 95.85/96.40.

R1-95.20

R2-95.85

R3-96.40

Support

S1-94.70

S2-94.10

S3-93.60