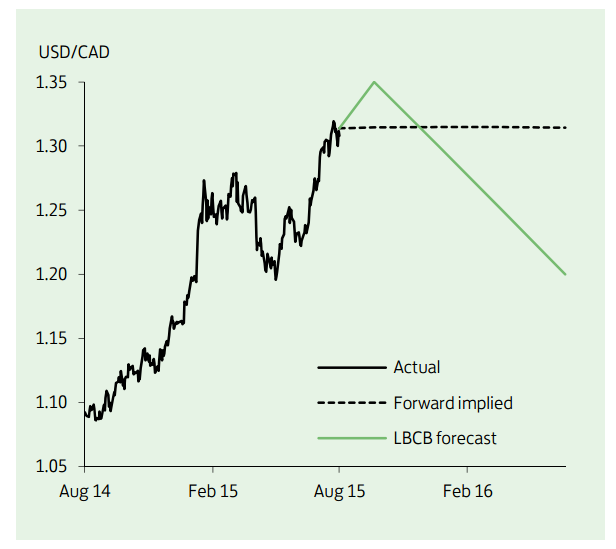

The depreciation of the Canadian dollar continued unabated over much of the past month, with USD/CAD hitting a new 11-year high above 1.32 in early August. The last couple of days, however, have seen heightened volatility, which has driven USD/CAD back below 1.30. Looking through the latest move, the fundamentals point to renewed weakness for the Loonie. The BoC cut interest rates by a further 25bp in mid-July in response to growing signs of economic weakness.

Monthly GDP posted a third consecutive contraction in May (and the fourth in the last five months). As such, the Canadian economy looks almost certain to re-enter technical recession when the full Q2 GDP figures are released on 1st September. With Governor Poloz acknowledging that a rise in US interest rates would help strengthen the USD and provide welcome support for the Canadian economy, there appears implicit official support for further CAD weakness over the short term.

"We look for USD/CAD to drop further and target 1.35 by end Q3. Further out, an anticipated recovery in oil prices should help USD/CAD drop back towards 1.20 next year," says Lloyds Bank.

USD/CAD Outlook

Wednesday, August 12, 2015 10:13 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022