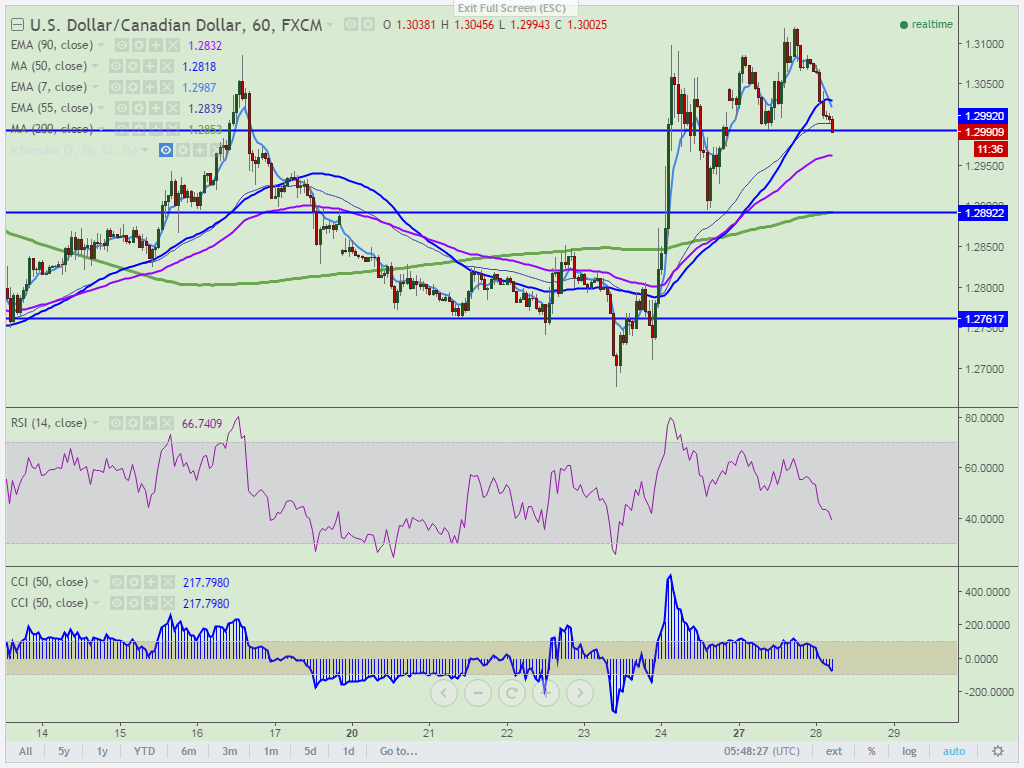

- Major Intraday resistance – 1.3057 (Hourly Kijun-Sen)

- Major support – 1.2990 (Yesterday Low)

- Lonnie has retreated after making a high of 1.31240 and declined from that level. It is currently trading around 1.29939.

- Short term trend is slightly bearish as long as resistance 1.3060 holds.

- On the higher side, major intraday resistance is around 1.3060 and any break above targets 1.3100/1.3125 (Jun 28th high).

- The major support is around 1.2990 any violation below 1.2990 will drag the pair down till 1.2960 (90 H EMA)/1.2920/1.2888 (daily Kijun-Sen).

It is good to sell on rallies around 1.29925-1.29950 with SL around 1.3060 for the TP of 1.2925/1.2885.