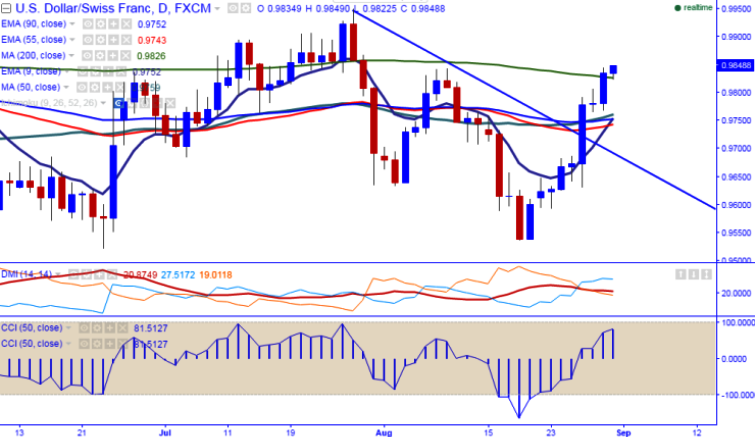

- Major resistance- 0.9830 (200- day MA).

- Major support – 0.9740 (55-day EMA).

- USD/CHF has jumped above 200-day MA till 0.9844 yesterday. It is currently trading around 0.9835.

- Any break above 200- day MA will take the pair to next level till 0.9900/0.9960. The pair is bullish as long as support 0.9740 holds.

- On the lower side, any break below 0.9740 will drag the pair till 0.9690 (daily Tenkan-Sen)/0.9630.The minor support is around 0.97720 (23.6% retracement of 0.95371 and 0.98470).

- Short term weakness can be seen only below 0.9630.

It is good to buy on dips around 0.9800 with SL around 0.9740 for the TP of 0.9900/0.9960

Resistance

R1- 0.9835

R2-0.9900

R3-0.9960

Support

S1-0.9740

S2-0.9680

S3-0.9635