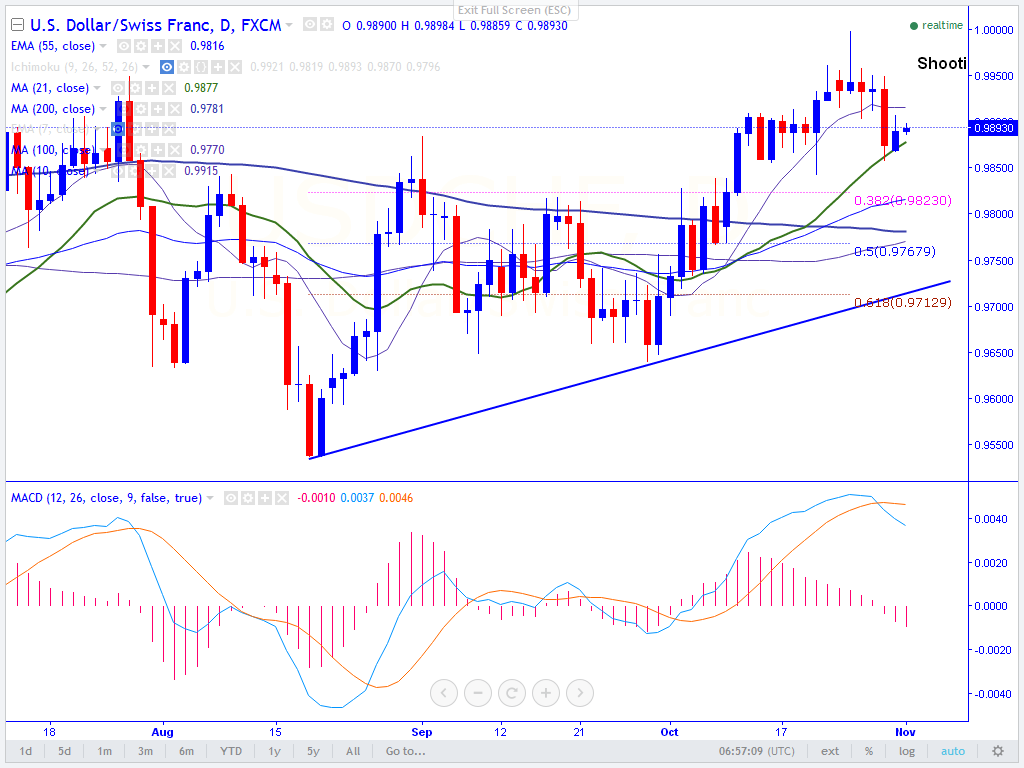

- Major support – 0.9860 (21- day MA)

- The pair declined slightly below 21- day MA and started to recover from that level. It is trading around 0.98934.

- Short term trend is weak as long as temporary top 1.000 holds. Any violation above 1.0000 confirms further bullishness, a jump till 1.0040/1.0090 is possible. The minor resistance is around 0.9915 (10- day MA)/0.9960.

- On the lower side, support stands at 0.9860 and any indicative close below targets 0.9780 (200- day MA)/0.9715 (61.8% retracement of 0.9537 and 0.9998).

- Short term reversal only above 1.000.

It is good to buy on dips around 0.9890 with SL around 0.9855 for the TP of 0.9960/1.00

Resistance

R1-0.9960

R2-1.0000

R3-1.0040

Support

S1-0.9860

S2-0.9780

S3- 0.9715