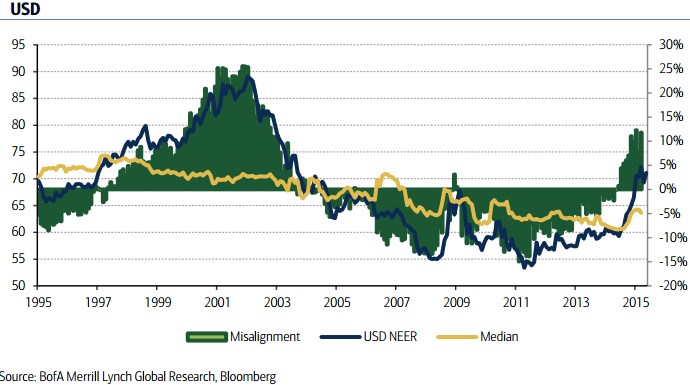

USD overvaluation appears large at 15%, raising some question on how much upside is left for USD. USD has room to strengthen further as the Fed enters a hiking cycle and considering that a decomposition of USD strength over the past year suggests only a small portion was due to Fed expectations. Even in the longer term, structural developments suggest that the USD equilibrium can shift somewhat higher.

Energy discoveries imply both stronger domestic growth and lower trade deficit, and the US has had substantially improved external imbalances post-crisis. In all, fundamentals in fact support secular USD strength, suggesting that, following over a decade of undervaluation in USD, we may be at the beginning of a sustained period of USD strength. Indeed the USD was overvalued by as much as 25% in the early 2000's.

USD has room to strengthen despite overvaluation

Thursday, September 10, 2015 9:21 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed