Officially the European Central Bank (ECB) has started its Asset purchase programme as of 1st March, 2015.

Purchase details -

- ECB will be buying € 60 billion worth of assets per month.

- The programme is an open ended one and is expected to be continued at least over the next 20 months.

- Large sections of the portfolio would include govt. securities.

Ratios and Risk -

- The purchase would be conducted by the national central banks in coordination with ECB and on a partial risk sharing basis.

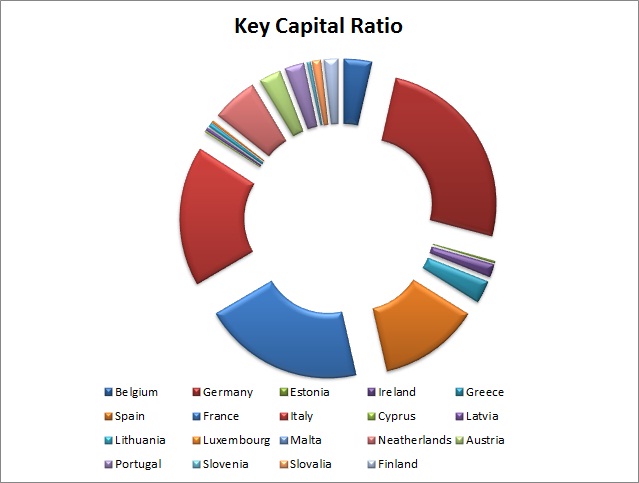

- The asset purchase would be based on key capital ratio that is explained in the chart and table. Top holders of the key capitals are Germany, France, Italy and Spain. All values are in %.

Probable impact -

- Economic activities and sentiments are expected to be boosted further.

- Euro zone bonds, especially the government securities could enjoy further lower yields. The yields would further be affected by purchase details and supply of securities.

- Euro would face headwinds due to the dovish stance of the central bank however would get boost from portfolio inflows.

|

Belgium |

2.5 |

|

Germany |

18.0 |

|

Estonia |

0.2 |

|

Ireland |

1.2 |

|

Greece |

2.0 |

|

Spain |

8.8 |

|

France |

14.2 |

|

Italy |

12.3 |

|

Cyprus |

0.2 |

|

Latvia |

0.3 |

|

Lithuania |

0.4 |

|

Luxembourg |

0.2 |

|

Malta |

0.1 |

|

Netherlands |

4.0 |

|

Austria |

2.0 |

|

Portugal |

1.7 |

|

Slovenia |

0.3 |

|

Slovalia |

0.8 |

|

Finland |

1.3 |

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate