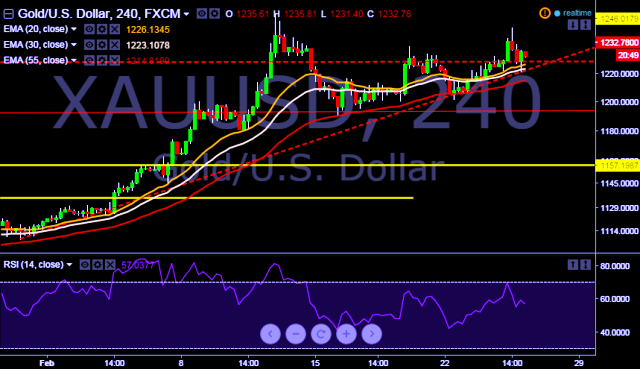

- Pair is currently trading around $1232 levels.

- It made intraday high at $1236 and low at $1221 levels.

- Intraday bias remains neutral for the moment.

- Expected range for today will be $1225- $1242 only.

- A daily close below $1221 will turn the bias bearish again.

- On the other side, current upward trend will take the pair towards key resistance at $1268, $1292 and $1300 levels thereafter.

- Key support levels are seen at $1227, $1222 and $1218 thereafter.

We prefer to take long position in XAU/USD around $1226, stop loss $1217 and target $1268/$1292 levels.