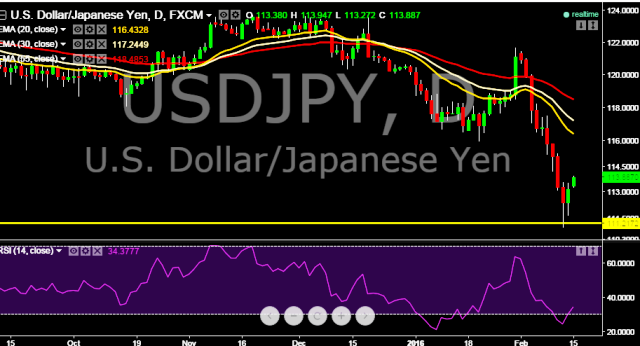

- Pair is currently trading at ¥113.87 levels.

- It made intraday high at ¥113.92 and low at ¥113.27 levels.

- Japan's economy contracted 0.4% in the December quarter, missing the consensus forecast of a 0.2% fall in production.

- Last week pair touched multi year low at ¥110.98 marks and currently Yen erased its previous gains and supported just below ¥114.00 marks.

- Intraday bias remains bullish for the day.

- A daily close below ¥110.98 marks will drag the parity towards ¥109 and 106.00 marks thereafter.

- Alternatively, reversal from this level will take the parity again above ¥115 marks.

We prefer to take long position in USD/JPY around ¥113.30, stop loss ¥111.50 and target ¥115.35 levels.