Global stock market got off to its worst New Year start in 2016, stocks continuously declined last week, due to spill over in concern stemming from China. At one hand China's stock market volatility soured the mood (which hit circuit twice last week, leading to a trading halt), tensions boiled over depreciation in Yuan, which had its worst weekly decline, after August forced devaluation in Yuan.

Key question facing global investors is "will stock market be able to recover from here?" if not, whole year's mood could turn sour, thanks to a phenomenon, known as January effect. Stock market is known to over-perform or underperform if January is positive or negative. Over that last 82 years, January effect was seen at least 65 times.

So a bad start in January is sure to turn off investors.

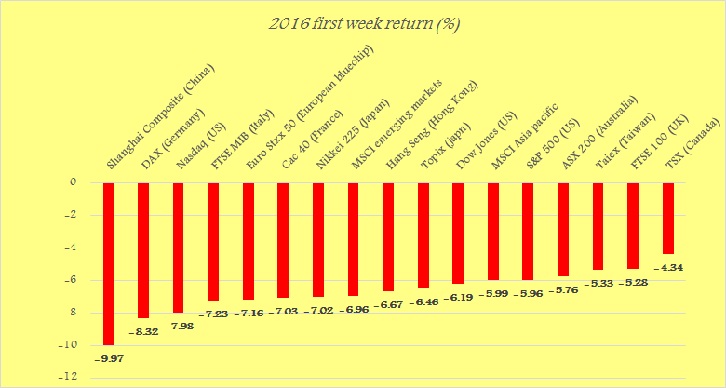

The figure shows, how stocks have performed in last one week. However not all had their worst start to a year.

Nikkei 225, MSCI Asia pacific and TSX had their second worst start to any year, while it is third worst for Topix and Taiex. Hang Seng seems to be not new early selloff. Had its seventh worst start.

For the rest others, 2016 had been the worst start.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX