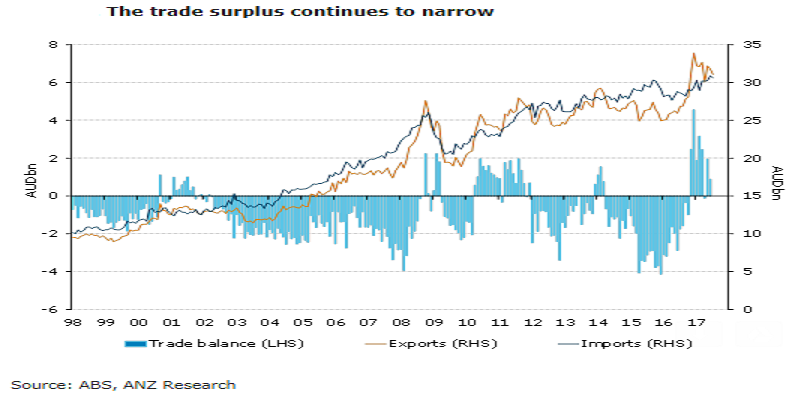

Australia’s trade surplus continued to sharply narrow during the month of July, driven by a broad-based weakness in the value of resources exports, down 2.2 percent m/m in July, with lower exports of other mineral fuels (-12.4 percent m/m) driving the change. Import growth was weaker, helping the trade surplus, with the recent strength in the AUD likely to have impacted the imports bill.

The trade balance narrowed substantially in July, with the trade surplus dropping to AUD460 million from an upwardly revised AUD888 million in June. This was weaker than expected. The sharp decline in the trade balance was driven by a larger-than-expected fall in exports. Meanwhile, the value of imports was also weaker, with the strength in the AUD likely to be one of the factors weighing on the national import bill.

The value of total exports dropped 2.2 percent m/m, subtracting AUD709 million from the trade surplus. The fall was largely driven by a drop in the value of resource exports, down a sharp 5.4 percent m/m (AUD949 million). The weakness in resource exports was broadly based, with exports of other mineral fuels down 12.4 percent m/m, or AUD387 million. Partially offsetting this weakness, exports of rural goods and exports of services edged higher – up 2.3 percent and 2.6 percent respectively.

The value of total imports fell in July by 0.9 percent m/m, adding AUD281 million to the trade surplus. The fall in imports was broadly based, with the exception of imports of services, which edged 0.8 percent higher in the month. After the surge in the previous months, imports of capital goods, (ex. civil aircraft) rose again, up 3.1 percent m/m. Imports of capital goods have been trending higher since April last year, mirroring the strength in business sentiment.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom