RBA lowered its main interest rate to 1.75% from 2% at its May 5th meeting and cut its Dec-16 inflation forecasts by a full percentage point in its quarterly Statement of Monetary Policy (SoMP) that followed. RBA’s inflation forecasts are centered on changing dynamics in wages and unit labour costs. The minutes released this week highlighted the Bank’s uncertainty over the inflation outlook, and its concerns about the second-round impact of lower inflation on wages growth.

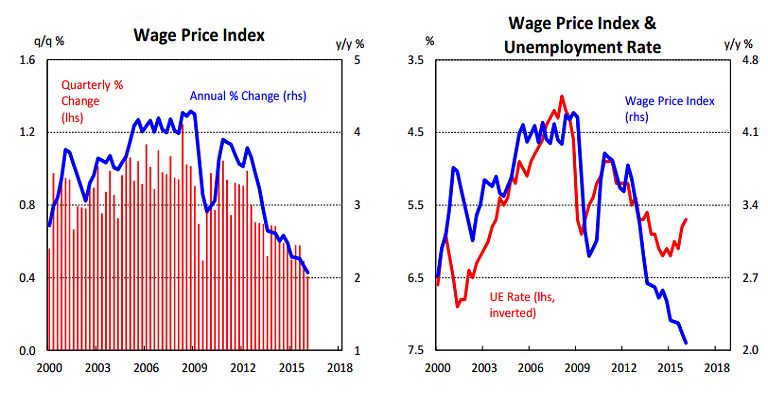

Data released by Australian Bureau of Statistics reported earlier today showed seasonally adjusted wage growth of just 0.4 per cent in the March quarter, leaving the Wage Price Index at 2.1 per cent on an annual basis. This was the weakest rate of annual growth since the data series first began in September 1998. Data follows the RBA’s minutes yesterday, in which the Staff Forecasts expected that growth in the Wage Price Index could stabilise around current quarterly levels.

"The continuing deceleration in wages growth means ongoing downwards pressure on inflation as it means a further fall in cost pressures for businesses. As such the latest reading on wages growth reinforces the RBA's decision to cut interest rates this month and is consistent with more rate cuts ahead." said Shane Oliver, head of investment strategy and chief economist at AMP Capital.

Markets now waiting for the closely watched employment report due on Thursday. Australia's unemployment rate fell to a 30-month low of 5.7 percent in March with annual jobs growth staying healthy at 2 percent. A Reuters poll expects a modest rise of 12,500 jobs in April and for a slight tick up in the jobless rate to 5.8 percent.

"Against a backdrop of soft price pressures globally, wage growth is expected to remain subdued in coming quarters. Ongoing low inflation and uncertainty about the outlook for global economic growth suggest another interest rate cut is on the cards. We have a rate cut pencilled in for August." St. George Bank said in a report to clients.

AUD/USD trading at 0.7280 at 1100 GMT. Lack of follow through above 0.7355 indicates weak momentum and a consolidation phase likely between 0.7200 and 0.7400 in the near term.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate