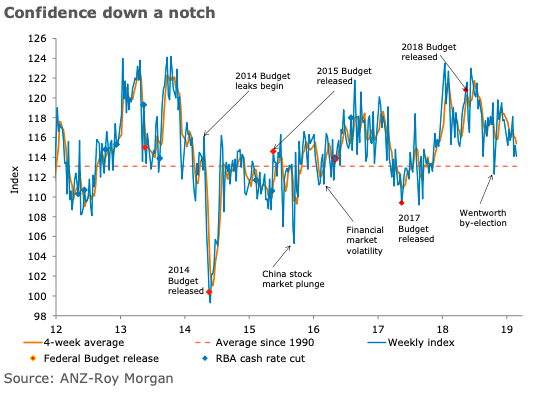

Australia’s ANZ-Roy Morgan consumer confidence retraced last week’s gain, declining 1.0 percent but remaining above the long-run average by some margin.

Financial conditions sub-indices were down with current financial conditions declining 0.9 percent and future financial conditions taking a bigger hit of 5.3 percent. This only took future financial conditions down to around the long-run average, however.

Economic conditions were mixed, with current economic conditions falling 1.6 percent while future economic conditions gained 0.5 percent. The ‘time to buy a household item’ moved higher for the second week, gaining 2.9 percent. Four-week moving average inflation expectations were stable at 4 percent.

"Confidence took a U-turn by falling 1.0 percent last week. The fall was somewhat surprising considering strong employment growth and reasonable wage data. The turn to a more negative outlook by one of the major Australian banks and news stories about a ban on Australian coal imports by Chinese port authorities that were then denied by authorities may have offset the positive economic data. Consumer confidence has effectively been in a holding pattern over the past three weeks, though the important thing to note is that it has remained above the long-run average," said David Plank, ANZ’s Head of Australian Economics.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment