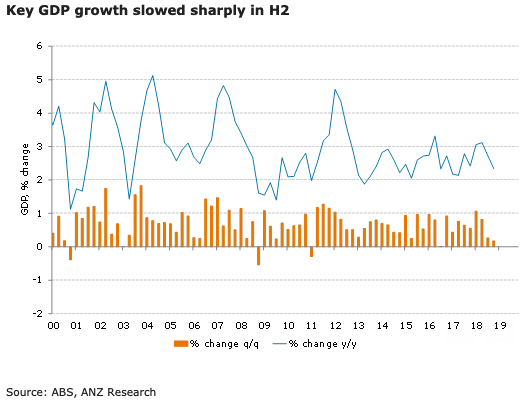

Australia’s gross domestic product (GDP) for the last quarter of 2018 slowed to 0.2 percent q/q and 2.3 percent y/y. Looking at Q3 and Q4 together shows that annualised growth in the second half was 0.9 percent, a sharp step down from 3.8 percent in H1, with a notable softening in the household sector.

Also, the result is significantly weaker than the RBA’s forecast of 2.8 percent y/y published in the February Statement on Monetary Policy, ANZ Research reported.

Q4 growth was also held down by weak exports, farm output and mining investment, while public spending and non-mining business investment were the bright spots. Housing construction fell 3.4 percent q/q, while household consumption was up just 0.4 percent q/q.

In contrast, the business, public and export sectors look solid. Non-mining investment rose a strong 2.4 percent q/q and expectations remain for further solid growth.

Public spending rose 1.5 percent q/q and is likely to continue to contribute to growth given a large pipeline of state-backed infrastructure spending and the rollout of the National Disability Insurance Scheme.

"The key uncertainty continues to be around the outlook for consumer spending in an environment of persistently low wages growth, and falling house prices. While household income is slowly picking up, households look to be realising that income growth will not rise to the pace that we saw last decade, and spending will need to grow more in line with income," ANZ Research commented in its latest report.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed