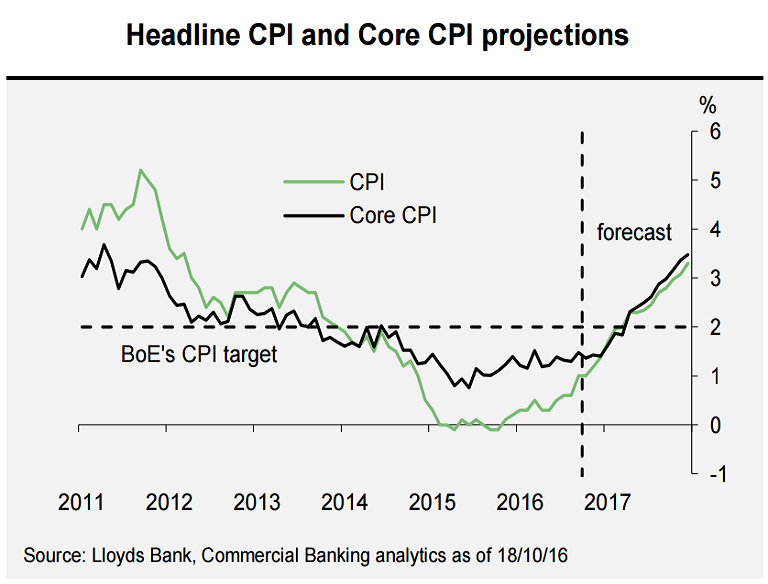

According to data released by the Office for National Statistics on Tuesday, U.K. headline consumer price index inflation rose to the highest rate in over two years in September 2016. The CPI inflation came in at 1 percent year-on-year in the month. CPI inflation in August was 0.6 percent year-on-year. This is the highest 12-month rate since November 2014, when consumer prices rose 1 percent. Consensus projections were for a rise of 0.9 percent.

The CPI ‘core’ rate (which strips food, energy, tobacco and alcohol) also rose in September, accelerating to 1.5 percent year-on-year from 1.3 percent in the prior month. Meanwhile, retail price index inflation accelerated to 2 percent annually from August’s 1.8 percent. This reflects certain residual pass through of the August Bank Rate reduction to the mortgage interest payments component.

The rise in inflation has been anticipated by the Bank of England policymakers, who have also stated that they will 'look through' any short-term rise due to the pound's weakness. The sterling is around 20 percent below its 2015 peak on a trade-weighted basis and further upward pressure on import costs is likely to feed through in coming months. The build-up of inflationary pressures suggests that policymakers may be less willing to loosen policy further in coming months, choosing instead to wait until the inflation outlook becomes more certain.

BoE governor Mark Carney has indicated that he would accept an inflation overshoot. At present, the BoE is focusing on supporting the economy. Other UK data this week, which includes retail sales and employment numbers don’t support the idea of a rate cut at the November MPC meeting and financial markets are pricing in just a 6 percent chance of such a move. However, economists see a much higher probability, which reflects comments from the BoE suggesting that officials will “look through” temporary higher inflation.

"BoE policymakers suggested that should the economic outlook remain as gloomy as they were predicting in August, they would likely cut rates again. We doubt that there will be any significant changes in the outlook for 2017 and 2018 and so think that the chances still narrowly favour further stimulus.” said ING in a report.

Trade-weighted sterling index hits 8-day high of 74.4, up 1 percent on the day. Cable was 0.69 percent higher on the day, trading at 1.2265 at around 11:45 GMT.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady