After delivering a comprehensive package of policy easing measures in August, the Bank of England (BoE) is widely expected to stay pat at Thursday's meeting. Focus is likely to be on the wording in the minutes which are released alongside the decision to gauge any changes to its easing bias. BoE Governor Mark Carney while addressing parliament, indicated that post-Brexit recession risks have receded and added that the central bank had further room to manoeuvre monetary policy if needed.

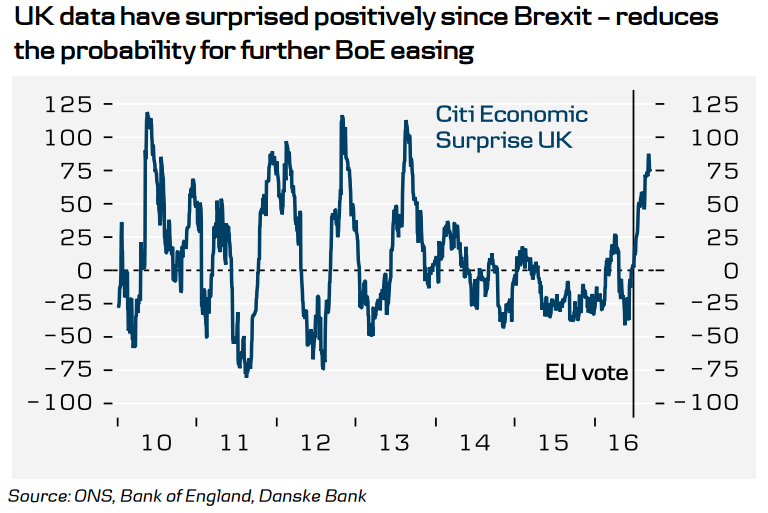

Economic data releases during August to a large extent have been better than expected and suggest that the UK has rebounded during the month after the initial deceleration in July. Upbeat data suggest that the UK economy may avoid a Brexit-recession. After nose-diving in what was a shock in the aftermath of the Brexit vote, UK PMI surveys have more than recovered those losses in August. NIESR GDP indicator has also been better than expected.

Today’s UK labour market data shows “no immediate impact” from June’s EU referendum. Data for the 3 months to July continue to paint a benign picture broadly maintaining previous pre-referendum trends. The employment rate is at 74.5 percent, the highest since records began in 1971. The claimant count measure of unemployment for August, showed a 2.4k rise, while July’s outsized decline was scaled back to reflect a 3.6k drop (previously -8.6k). UK average earnings, however, slowed sharper than expected to 2.1 percent from 2.3 percent, which could become troublesome if UK inflation continues to rise due to the weak pound, and could create a contraction in real earnings.

Labour market trends tend to lag changes in economic activity and it will be some time before the post-referendum change in the demand and supply outlook is visible in the labour market data, leaving the principal focus on activity indicators, with tomorrow’s August retail sales data likely to provide key insight.

"Despite better data, we cannot rule out further Bank of England (BoE) easing later this year, as the BoE has indicated that it will cut rates if its growth forecast (0.0%-0.1% q/q in Q3) materialises. We expect the BoE to stay on hold at its upcoming meeting on Thursday. We still expect a 15bp cut from 0.25% to 0.10% in November, but it is a very close call." said Danske Bank in a report to clients.

UK gilts traded narrowly mixed Wednesday as investors await the Bank of England monetary policy decision. The yield on the benchmark 10-year gilts rose nearly 1 basis point to 0.923 percent, the super-long 40-year bond yield jumped 3 basis points to 1.487 percent and the yield on short-term 2-year bond slid 2 basis points to 0.189 percent by 09:50 GMT. FTSE 100 traded 0.63 percent higher at 6,707.60 by 09:50 GMT. GBP/USD was at 1.3199, up 0.02 percent at around 10:15 GMT.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate