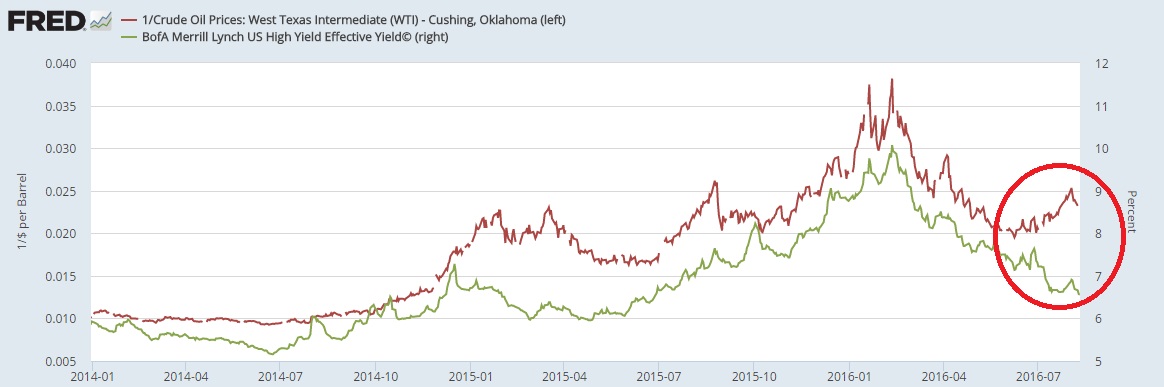

This chart made by us at FxWirePro, in St. Louis Fed's economic dashboard shows how the U.S. high yield bonds have gotten along with the crude oil price (inverse scale). How many barrels of crude a dollar buys vs. Effective yield calculated by Bank of America Merrill Lynch (BofAML).

Since 2015, they had have shown a very high level of intimacy, Crude went down, the yield went up. Both recovered since February.

However, recently these two, have diverged. the oil price edged lower but yields edged lower too. We wonder if the oil doesn't affect the financial position of the high yield companies anymore, the worst is over or is that the investors don't care? Just being crazy about the yield/return? And there will be no credit risk since the money printing is forever!!!

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence