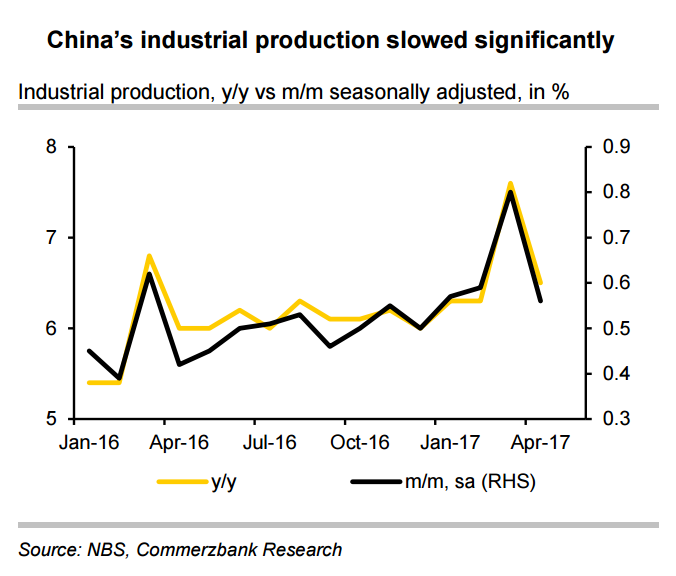

China’s activity data came in weaker than expected in April suggesting a weak start to the second quarter despite apparent resilience in domestic lending activity. Data released on Monday showed that China's industrial output rose 6.5 percent in April from a year ago, missing Reuters' expectations of 7.1 percent and down from 7.6 percent growth seen in the previous month. Industrial production miss was another sign that growth momentum in the world's second largest economy is slowing.

Retail sales grew 10.7 percent year on year in April, down from 10.9 percent rise seen in March. April's rise was slightly above a median estimate of 10.6 percent forecast in Reuters' poll. Sales growth at larger enterprises dropped to 9.2 percent from a pace of 10 percent in March. Online sales growth for the year to date accelerated marginally to 25.9 percent, compared to growth of 10.2 percent in the four months ended April.

Urban fixed-asset investment (FAI) moderated to 8.9 percent year on year in April, down from growth of 9.2 percent in March and falling short of expectations for a 9.1 percent rise. In the meantime, the private investment also slowed to 6.9 percent y/y in the first four months, versus last reading at 7.7 percent. Retail sales gained10.7 percent y/y in April, compared with 10.9 percent in March.

Several weaker-than-expected data in recent weeks raised concerns that the world's second largest economy is losing steam. China’s authorities have significantly lowered March’s sequential growth for FAI to 0.76 percent m/m, from initial reading of 0.87 percent. This downward adjustment points to the fact that the investment growth has already lost steam.

Further, both China’s official and private manufacturing PMIs illustrated a weakening bias in April. China's iron ore imports, which are seen as a proxy of China’s infrastructure spending, declined by 2.0 percent y/y in April on volume terms which point to a moderation in China’s industrial sector in the coming months. While housing investment picked up somewhat in April, the leading housing investment and housing prices data indicate that the property sector is headed for a serious deceleration in the second half of 2017.

"We believe that China’s headline GDP growth is likely to have peaked in Q1 already, and therefore China’s growth profile will gradually moderate towards 6.5% in the coming quarters," said Commerzbank in a report to clients.

After a brief phase of consolidation following the release of the Chinese data dump the Aussie extends upside supported by gains in the commodity block. AUD/USD continues to gain momentum amid gains in European equities, higher treasury yields and broad based US dollar weakness. USD/CNY was 0.03 percent lower at 6.8950.

FxWirePro's Hourly USD Spot Index was at -149.943 (Bearish), while Hourly CNY Spot Index was at 128.265 (Bullish) at 1030 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains