China's trade data for July released earlier on Monday set tone for a rocky start for the third quarter. Customs China released their latest report on the Chinese trade which showed that the country’s trade surplus and exports bettered expectations, while imports surprised to the downside. Data suggested global demand remains weak in the aftermath of Britain's decision to leave the European Union.

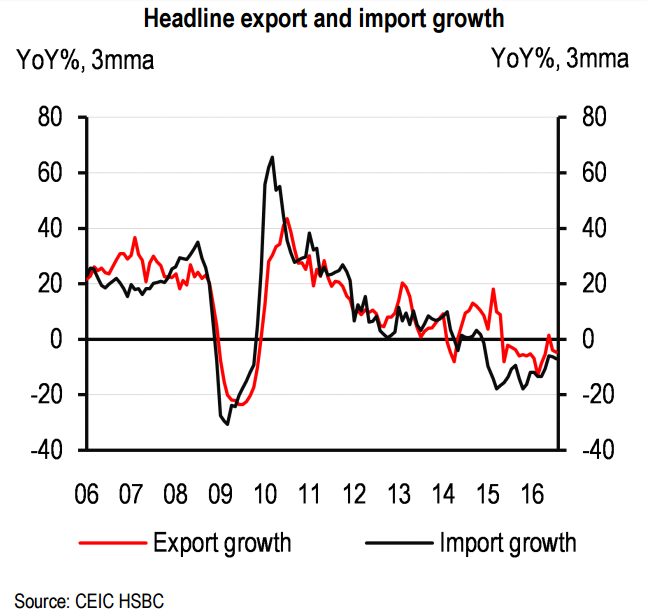

China's trade surplus came in at $52.31 billion in July, up from $48.1 billion in June. Exports fell 4.4 percent on-year, roughly in line with market expectations. Imports fell 12.5 percent in U.S. dollar terms, more than expected. In yuan terms, July trade data showed exports rose 2.9 percent on-year and imports fell 5.7 percent.

Imports of major commodities saw broad-based slowdown in both value and volume terms, likely the result of weakening manufacturing sector growth and a cooling property market. The y/y growth in imports of crude oil and copper fell sharply, both from around 20 percent in recent months, to 1.2 percent and 3.4 percent y/y respectively in June. Iron ore was only slightly better, with imports up 2.7 percent y/y (down from 8 percent y/y in June).

"The country's export growth is likely to remain subdued for some time. While we think the worst is probably over for many emerging markets, global growth is likely to remain lackluster well into next year," said Julian Evans-Pritchard, an economist at Capital Economics.

These relatively weak import numbers are likely the result of high inventory build-up in Q2 2016. With the impact of Brexit still hanging over China’s export-driven demand, commodity imports should experience even further weakness in the coming months. Data raises scope for more growth-supportive policies by the Chinese authorities. People’s Bank of China is likely to favour using liquidity tools rather than cuts to interest rates to support the Chinese economy.

"Overall, the disappointing imports data today suggests that the underlying momentum of demand stabilization is still quite fragile. We expect the government to step up with multiple ways to lift domestic demand in the coming quarters, including more aggressive monetary easing, faster pace of fiscal expansion and more supply-side reforms." said HSBC Global in a research note.

China shares inched up on Monday morning, as a surge in coal stocks and sustained interest in property shares ignited by the Vanke drama offset the impact of worse-than-expected trade data. Hong Kong's Hang Seng index closed up 1.6 pct at 22,494.76 points, while China's CSI300 index closed up 0.9 pct at 3,234.18 points. USD/CNY was at 6.6608 at around 10:20 GMT.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand