The Reserve Bank of New Zealand's (RBNZ) expansionary monetary has helped New Zealand's economy develop well over the past year. The nation's real Gross Domestic Product (GDP) rose by 0.8-0.9 percent q/q over the past four quarters. The domestic economy and rising exports which were supported by a recovery of commodity prices have proved to be the main drivers.

That said, downside risks to New Zealand's growth remain high. Poor growth outlook for China and still low commodity prices continue to weigh on New Zealand's growth outlook. Despite some pickup, the RBNZ remains severely concerned about the low milk prices and has lowered its medium-term forecast for the price of milk powder by almost 10 percent. Domestic dairy sector accounts for over one quarter of New Zealand’s exports and weakness in milk price will hurt terms of trade and thus dampen the growth outlook.

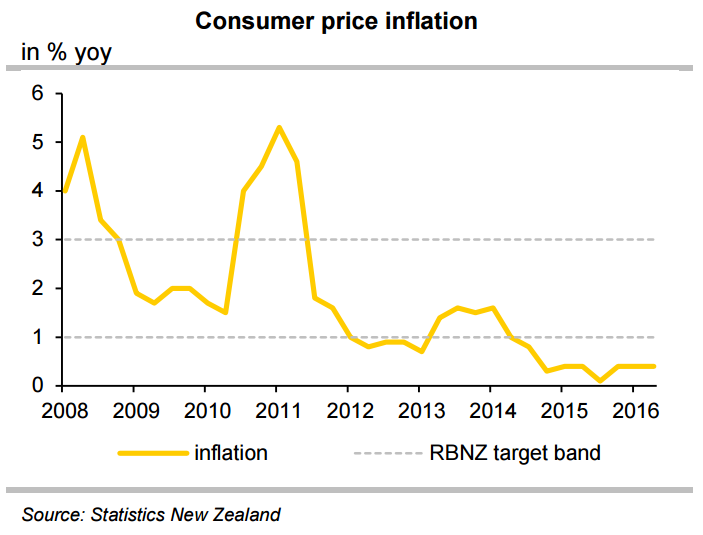

Inflation in New Zealand also remains low despite decent growth. Inflation has been below the RBNZ’s 1-3 percent target range since late 2014. RBNZ efforts to prop up inflation with rate cuts have been countered by strong exchange rate which keeps tradable goods inflation in negative territory. NZD trades above the levels anticipated by the RBNZ on a trade-weighted basis.

At its last meeting in November, the central bank signalled that its rate cut cycle was over, but vice governor John McDermott warned that the central bank would not hesitate to cut key rates further should the currency continue to appreciate. RBNZ does not only see the depreciation of the NZD to be desirable, but as necessary.

Donald Trump’s election victory has raised inflation and consequently interest rate expectations in the U.S., which would exert downside pressure on the NZ dollar. Against the euro, moderate NZD appreciation is seen as the improving growth outlook compared to the euro zone supports the NZD slightly.

NZD/USD was trading at 0.7093, while EUR/NZD was at 1.5141 at around 12:30 GMT. At the said time FxWirePro's Hourly USD Spot Index was at 19.5385 (Neutral bias), EUR Spot Index was at -11.0629 (Neutral bias) and NZD Spot Index was at -44.6194 (Neutral bias).

For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm