The European Central Bank left ultra-loose monetary policy unchanged on Thursday and maintained its monthly QE purchases of EUR80bn. The central bank kept the door open to more stimulus in December, firmly shooting down any talk of tapering its 1.7 trillion euro asset-buying program.

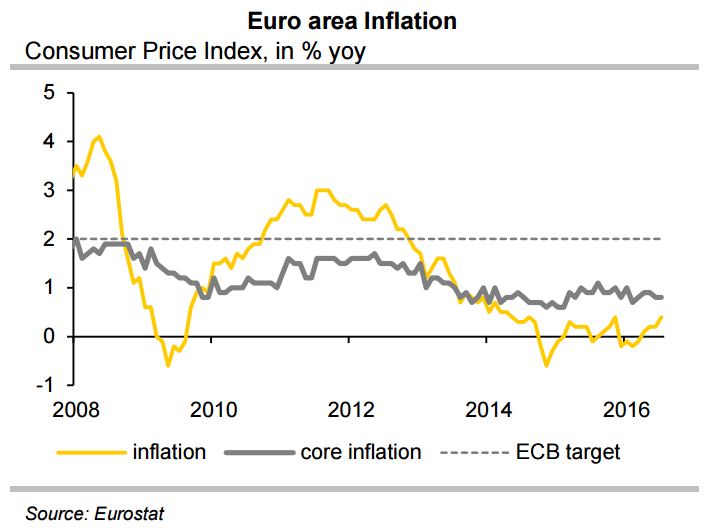

ECB President Mario Draghi did not provide any clues regarding the central bank's next move. Regarding inflation, Draghi emphasized that a long-awaited rise in inflation is predicated on "very substantial" monetary accommodation. However, he said that “there are no signs of a convincing upward trend in core inflation”.

ECB has provided unprecedented stimulus for years with the aim of boosting inflation. The overall inflation rate will rise as a result of base effects (the decrease in the oil price is falling out of the annual rates) over the coming months and can therefore not really be used as the main argument in favour of a more expansionary monetary policy.

It is clear that the ECB only wants to announce an extension of the asset purchasing programme once it can communicate clearly to the market how it will treat the issue of scarcity (the foreseeable limitation of eligible bonds if it extends the purchasing programme) and it will then also have to adjust some of the parameters of the purchasing programme.

"If, as we expect, the ECB extends QE by nine months, we estimate that under the current regulations it would by early summer 2017 no longer be able to find sufficient Bunds suitable for purchase. Consequently, in December the Bank will have no choice but to change the rules of the program," Commerzbank said in a note.

EUR/USD initially rose 0.5 percent to 1.1040 on Draghi's comments that an extension was not discussed but eased back to a four-month low of 1.0921 as markets are increasingly pricing in more easing. The major was 0.39 percent lower on the day, trading at 1.0886 at around 12:40 GMT.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary