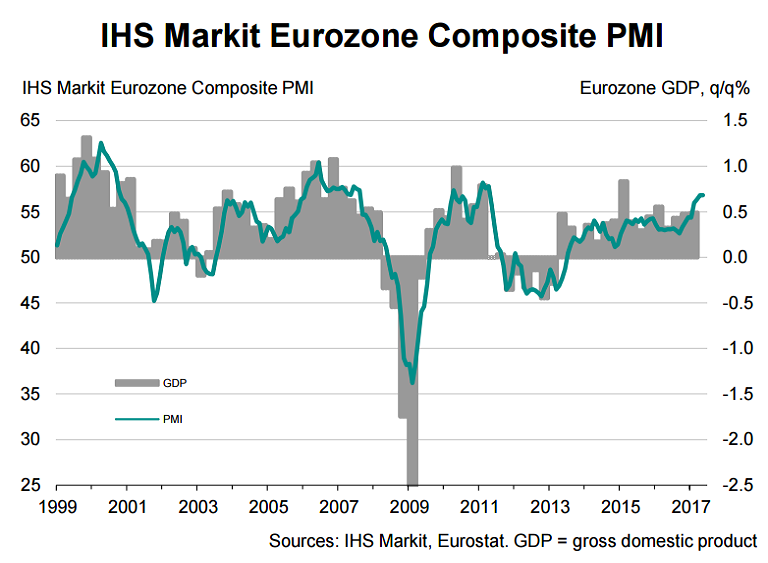

Eurozone business activity remained strong in May, as indicated by survey compiled by IHS Markit. Markit's eurozone final composite Purchasing Managers' Index came in at 56.8 in May, unchanged from both April's index and the May flash estimate. The rate of eurozone economic growth continued to run at the quickest pace in six years during May. The index has held above the 50 mark that divides growth from contraction since mid-2013.

"The outlook for the euro zone economy seems to be tilting to the upside, and it seems likely that we'll start to see many forecasters' expectations for 2017 growth revised higher," said Chris Williamson, chief economist at survey compiler Markit.

The pace of growth indicated in the survey was putting the eurozone economy on a path towards a sustained recovery. The survey compiler, IHS Markit, said its data was consistent with gross domestic product (GDP) growth of 0.7 percent in the second quarter, higher than the 0.5 percent rate economists predicted in a Reuters survey.

The services PMI edged down to 56.3 in May from 56.4 in April, although it was up marginally from a flash reading of 56.2. Both the hard data and the surveys are revealing a broad-based upturn. Revisions to first quarter GDP estimates are now bringing the official numbers more in line with the surveys.

Details of the report showed new businesses sub-index climbed to 55.9 from a flash reading of 55.5, suggesting activity in the coming months will remain solid. The output prices index showed output prices rose at a slower pace in May, falling to 52.4 compared with a flash estimate of 52.8. Job creation is rising to one of the highest seen over the past decade. An improved labour market should feed through to higher consumer spending.

Market focus in the coming week will be on the conclusion of the European Central Bank's (ECB) latest Governing Council meeting on Thursday, which also includes publication of the central bank's updated economic forecasts. No ECB policy change is expected but the bias that comes through in President Draghi’s press conference will be very closely examined. The ECB is expected to revise up its assessment of economic growth to "broadly balanced", but will reiterate that underlying inflation remains subdued.

"We expect the ECB to drop the reference in the post-meeting statement that interest rates might yet be cut further and that the amount of monthly asset purchases might be increased. And while a formal announcement might not come until July, Draghi might also hint that the ECB will launch work at staff level over the summer to prepare options for the next steps of the QE programme once the currently planned asset purchases of EUR60bn per month up to year-end have been completed," said Daiwa Capital Markets in a report.

EUR/USD was trading 0.32 percent lower on the day at 1.1242 at around 1130 GMT. The pair is consolidating after hitting fresh six – month high of 1.1284 on Friday on account of weaker than expected U.S Nonfarm payroll. Bias is still bullish as long as minor support 1.1197 (daily Tenkan-Sen) holds. Any break below will drag the pair down till 1.1160/1.1100 (May 30th low). The near term major resistance is around 1.1300 and any break above will take the pair till 1.13660/1.14300. Short term bullish invalidation only below 1.05695.

FxWirePro's Hourly EUR Spot Index was at -91.676 (Bullish), while Hourly USD Spot Index was at -61.5483 (Slightly bearish) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand