Inflation trend in Norway has accelerated since the start of the year, contrary to Norges Bank’s expectations. Norwegian central bank had maintained a generally pessimistic economic outlook and stuck to its expansionary monetary policy till its June meeting. It has lowered key rate by a total of 100bp to now 0.50 percent since late 2014. As a result, the Norwegian krone has depreciated by approx. 15 percent in the two years since mid-2014 on a trade-weighted basis.

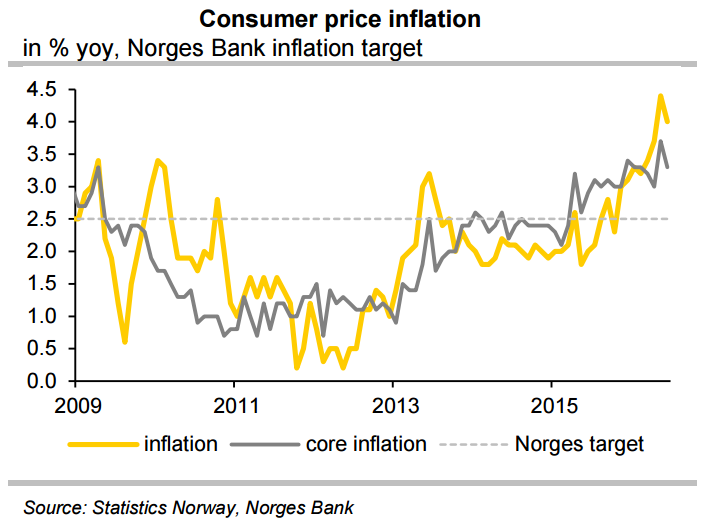

Having being excessively pessimistic about the economic outlook, the Norges bank has largely ignored its inflation target. There has been a massive overshoot of its 2.5 percent inflation target. Norway's core inflation rate has been moving above the inflation target since mid-2015, the headline rate since early 2016. The main inflation driver is the weak krone which makes imports more expensive and is thus driving consumer prices up.

At its September meeting, the Norges Bank raised the rate path and now expects the key rate to remain at current levels. In the first quarter, the Norwegian economy recorded surprisingly strong growth of 1 percent q/q (seasonally adjusted). The bank now forecasts growth of 0.7 percent for the year, up from 0.1 percent earlier. However, still assumes that the economy will weaken in the second half of the year due to a shrinking oil and gas sector. The central bankers pointed out that the likelihood of a rate cut remains higher than that of a rate hike.

"In our view Norges Bank’s decision against a further easing of monetary policy was mainly due to the improved economic outlook and less due to higher inflation. In view of a still expansionary monetary policy and robust economic growth we still see increased inflation risks," said Commerzbank in a report.

The Norwegian government published the 2017 fiscal budget today which is slightly less expansionary than Norges Bank’s projections. It suggests Norges Bank will continue to buy NOK at a roughly unchanged pace in 2017 relative to this year. However, purchases are not aimed at strengthening the NOK. On the contrary, the fiscal rule is aimed at preventing NOK appreciation.

With the ECB most likely to continue with easy monetary policy bias and as the Fed to continue gradually raising its key rates NOK is likely to depreciate against USD and appreciate mainly against EUR. EUR/NOK was trading at 8.9931, while USD/NOK was at 8.0416 at 12:00 GMT.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions