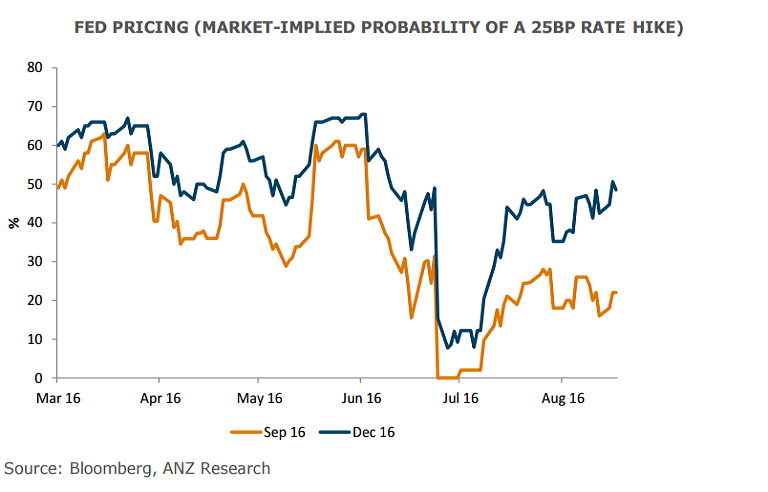

US Federal Open Market Committee minutes released overnight highlight that officials are divided, with no clear indication of when the central bank will hike next. The minutes showed that members were generally upbeat about the economic outlook and labor market, but several said a slowdown in the future pace of hiring would argue against a near-term hike. The market currently is 22 percent priced for a move in September and just under 50 percent for December.

Fed officials have recently reminded the market not to be too complacent and that the bias at the Fed is still to raise interest rates. NY Fed president Dudley’s said on Tuesday that markets are too complacent about rate hike risks. Dudley said he expected stronger growth in the US in H2 than in H1 and further improvement in the labour market. That sentiment was echoed by FRB Atlanta President Lockhart.

“Hawks balanced with doves and the Fed in wait-and-see mode,” said Kit Juckes, strategist at Societe Generale. “I don’t think this tells us much about the September meeting, which is, as ever, data- and market-dependant, but it does tell us that the most we’ll get is a very slow and cautious tightening path.”

The key to when the central bank moves remains the underlying data flow. Recent data suggest growth probably accelerated in Q3. Headline Q2 GDP growth (+1.2 percent saar) was disappointing, but underlying activity was still positive and will remain supported by stimulatory financial conditions. Residential investment, which was a significant drag on Q2 GDP appears to be recovering. Recent solid gains in employment suggest underlying momentum is better than the headline GDP.

That said, despite signs of a pickup in wage growth, headline inflation remains below target. July CPI fell to 0.8 percent y/y from 1.0 percent in June and the PCE is hovering at 0.9 percent y/y. Core inflation is closer to the Fed’s 2 percent target. University of Michigan 5-10yr inflation expectation remains low but stable at 2.6 in July.

"An ongoing tightening in the labour market and relatively stable inflation expectations point to a gradual return in headline (PCE) inflation towards the target (2 percent) over the near to medium term," said ANZ in a report to its clients.

The FOMC's next meet (21-22 Sept) will be accompanied by a press conference from Janet Yellen and the updated Summary of Economic projections (including the fed fund rate). Hurdle probably remains a little high for September rate move. Another round of monthly data (employment and CPI) will be available for scrutiny. However, one month of data may not be sufficient to provide the confidence the Fed needs.

The dollar saw choppy trading, shorter-term Treasury prices turned higher and stocks nudged into positive territory after the release of minutes on Wednesday. DXY extending dips on the day, down 0.36 percent at 94.39 at 11:30 GMT. USD/JPY was at 100.19 while EUR/USD was at 1.1327.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated