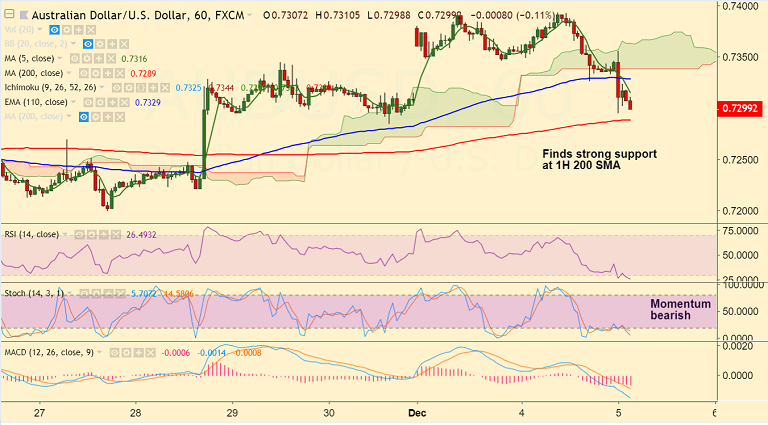

AUD/USD chart on Trading View used for analysis

- AUD/USD has resumed downside after a brief pause, bulls dented by dismal Australia Q3 GDP data.

- Australia September quarter GDP arrived well below estimates, supporting the view that RBA will keep rates unchanged through 2019.

- The pair edged slightly higher as a big beat on the Chinese Caixin November services PMI offered some reprieve to the Aussie bulls.

- China Caixin/Markit Nov Services PMI hit a 5-month high of 53.8 versus Oct’s 50.8 and beating estimates at 50.8, led by the rise in new orders.

- However, markets seems to have brushed aside upbeat China data and the major has resumed declie.

- We see strong support at 1H 200 SMA at 0.7289. Violation there could see further weakness.

- On the flipside, the pair has slipped below 5-DMA and retrace above could see gains upto 200-DMA.

Support levels - 0.7289 (1H 200-SMA), 0.7279 (110-EMA), 0.7266 (20-DMA)

Resistance levels - 0.7322 (5-DMA), 0.7363 (Upper BB), 0.7412 (200-DMA)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures