The Chinese copper demand has been seriatim at a concrete pace in 1st half of 2017 owing to the strong performance of the consumer goods sector and firm infrastructure spending, but strong demand conditions in May and June gave way to weaker demand in July.

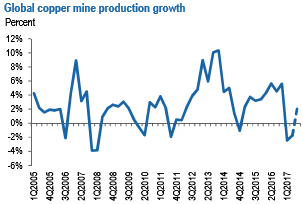

The global copper mine production contracted by 2.3% yoy in 1H, but rising spot TC/RCs confirm balanced concentrate market in 3Q.

On net, the market looks set to record a fourth consecutive year of surplus in 2017, followed by another in 2018.

• Vulnerable to profit-taking (overbought)

• Largest money-manager long position since 2006

• Largest money-manager net long position since 2006.

Despite most of the major supply-related problems being largely resolved, supply continued to dominate copper market headlines in 2Q.With 2Q production reports almost complete, we now estimate that global copper mine production contracted 2.3% yoy in 1H (refer above chart).

The previous price forecast of JP Morgan envisioned a relatively strong 2Q’17 as we entered the seasonally-stronger period for demand. We were targeting sequentially weaker pricing in the second half, supported by our expectation that Chinese demand would roll over in 2H.

To this end, despite demand indeed softening last month, July and August prices surprised sharply to the upside, resulting in us upgrading our forecasts 6%, on average, for 2H.

We now anticipate the LME copper spot price to average $5,766/t in FY 2017, representing a YoY increase of 18.5%. We continue to see a weaker pricing environment into the rest of year, but especially in 4Q’17. We forecast copper prices to decline 8% YoY in FY 2018 to an average $5,300/t, weighed down by both strong growth in mine supply and lower demand globally, but especially in China.

Courtesy: JP Morgan

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary