The Australian economy is expected to witness an economic growth of around 3 percent in the upcoming year, coupled with a decline in the country’s rate of unemployment, from its current 5.4 percent, strongly owing to expectations of a solid CAPEX. Also, a rise in the non-residential building approvals indicates that a strong level of private investment is on its way.

Echoing that is the uplift in the public infrastructure that is trickling down to demand dynamics as well. Both government consumption and investment are picking up. Growth in public consumption has been broad-based across states and sectors, while public infrastructure spending is picking up strongly, particularly in New South Wales.

Housing construction is set to slow through 2018, although only gradually. A considerable amount of work is still in the pipeline, while approvals have fallen only modestly from the recent peak compared with recent cycles. In recent months building approvals have picked up slightly, while housing finance commitments for construction are still rising strongly. Together this suggests that activity should slow only gradually through 2018.

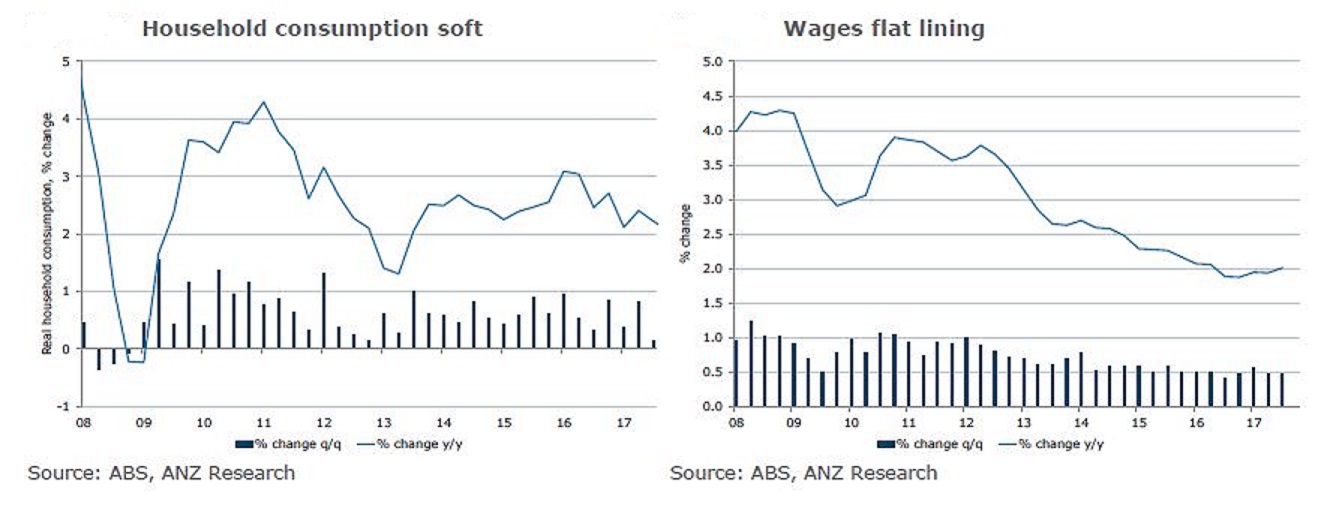

However, household spending is unlikely to witness much of a boost, owing to softer growth in wages and a huge pile of debt. But household income growth is likely to accelerate. Given this, we, at FxWirePro, foresee that the wage component of the GDP measure will broadly match the wage price index over the New Year.

"This will help to lift growth in nominal household income from close to 2 percent in Q3 2017 to above 5 percent by early 2019. It does, though, allow spending to remain broadly at the pace of the past few years, without a sharp decline in the saving rate," ANZ Research commented in its recent report.

While the Australian dollar remained on a topsy-turvy path this year, regaining some momentum through halfway 2017 and then again suffering as the end of the approached, we expect to see some upside strength in the currency, if expectations are met for some upbeat reading of the economy.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility