USDJPY is vulnerable into and through the September 21 Bank of Japan (BoJ) policy decision. We highlight the potential for disappointment and a possible market reaction similar to that observed in July and April, with the risk of the extended move that followed the January misfire.

The downside risk is amplified by the escalation in expectations relating to the policy outlook. The scrutiny has intensified in the aftermath of the July 29 announcement of a comprehensive assessment of the BoJ’s current policy trajectory termed ‘Quantitative and Qualitative Monetary Easing (QQE) with a Negative Interest Rate’.

Recent media reports have hinted to the emergence of discord among BoJ board members, with some favoring a deeper dive into negative interest rate territory, others looking to an acceleration in the pace of balance sheet expansion and a couple looking to hold steady.

USDJPY’s risks are amplified by the impending FOMC policy decision also scheduled for September 21. Any spike in risk aversion would be expected to deliver pressure to USDJPY.

The yen backed away from one-week lows against the dollar on Wednesday amid doubts that possible further easing by the Bank of Japan would cause a significant downside for the currency.

While in some senses understandable, speculative demand for USD/JPY seems at odds with the relative performance of the US and Japanese bond markets whereby 10Y JGB yields have pushed to their highest levels since March and the spread to UST has remained closed to the lows for the year.

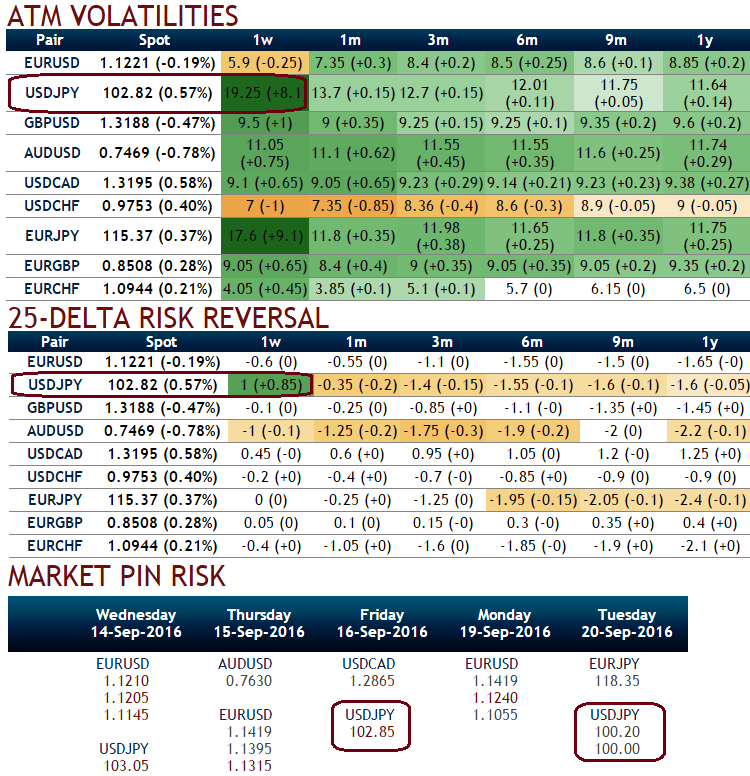

OTC updates:

As per the nutshell showing implied volatilities and delta risk reversals, USDJPY is the pair to have highest 1W IVs with hedging sentiments for upside risks in this tenor as a result of above fundamental drivers. Whereas the long-term hedging arrangements for downside risks still appear to be intact. Hence, we recommend below option strategy so as to match the above fundamental as well as the OTC scenarios.

While USDJPY pin risk is seen in options expiring on this Friday at strikes 102.85 and 100.20 and 100, FX Options strikes in large notional amounts, when close to the current spot level, can have a magnetic effect on spot prices. That is, the spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

Option Trade Recommendation:

USDJPY is trading at 102.443, up 0.23% after rising as high as 103.35 earlier, the most since September 6.

So while the market is happy to buy USD/JPY as a positively convex play on the BoJ meeting, the result of such demand is that USD/JPY is now 2% expensive compared to the 10Y rate spread. Hold a USD/JPY put fly (100x98x96 in 1x2x1 notional) with 1w expiry.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.