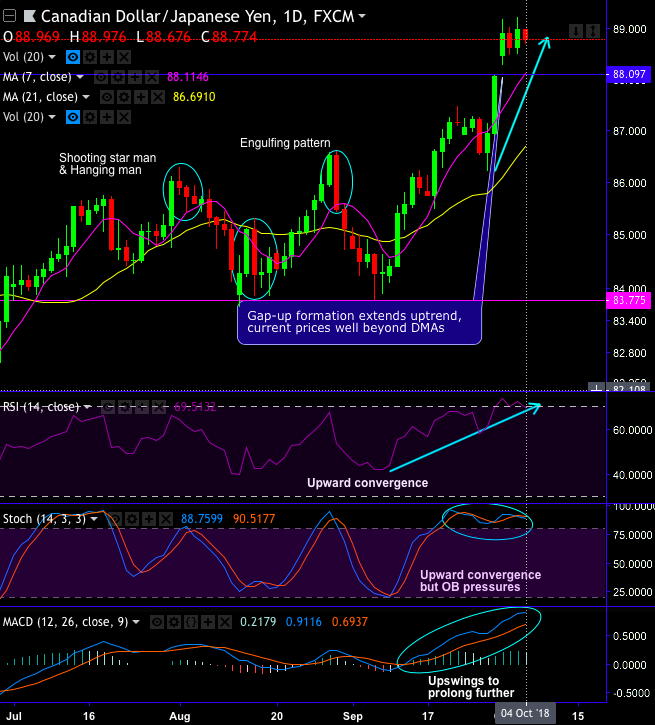

CADJPY forms gap-up opening chart patterns at 88.470 levels (which is bullish in nature) that takes-off price rallies well above DMAs and EMAs on both daily and monthly plotting.

Well, with an intention of productively trade such gapping occurrence, a shrewd and smart trader should certainly follow a methodical and meticulous set of entry and exit rules so as to maximize yields and minimize risks.

By-the-way, gap trading strategies can be deployed on timeframes but be sure for longer-term investors to understand the mechanics of gaps (whether it is break-away or run away or exhaustion gaps). Because sometimes, the 'short' indications, at times, could be utilized as the exit point to sell holdings.

The stiff resistance zone is observed at 89.739 and 91.691 levels, for now, more rallies likely on bullish DMA, EMA & MACD crossovers that indicates the uptrend continuation.

While both momentum oscillators (RSI & Stochastic curves) on monthly terms show upward convergence that indicates the strength and the intensified momentum in the prevailing upswings.

But daily RSI and stochastic curves are popping-up with overbought pressures, hence, it is wise to capture potential dips so as to provide a better entry level for the fresh long trades. Strong support is seen at 88.111 levels (i.e 7DMAs).

On a broader perspective, the major downtrend of this pair has gone in consolidation phase since December 2015 (refer monthly plotting for range-bounded trend). Shooting star pattern has occurred at 83.969 levels hampers previous bullish momentum on this timeframe.

Trade tips: Well, on trading perspective, at spot reference: 88.770 levels, contemplating above-stated bullish pattern, it is advisable to buy one-touch call option using upper strikes at 89.739 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX keeps flying on the expiry duration.

Alternatively, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards 83.500 levels in the near terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards 96 levels (which is bullish), while hourly JPY spot index was at -10 (neutral) while articulating (at 05:55 GMT). For more details on the index, please refer below weblink: